Buyers and sellers both benefit from understanding the peculiarities of an asset purchase and a stock purchase. These two acquisition methods determine how ownership, assets, and liabilities are transferred from the target business entity to the acquirer.

This article explores the key differences between a stock acquisition and an asset acquisition and dives into the rationale behind each, from both buyer and seller perspectives.

Overview of asset acquisitions

An asset acquisition is when a purchaser acquires tangible and intangible assets of a target company, such as equipment, machinery, real estate, customer contracts, or intellectual property. Accounts payable and accounts receivable are also valuable in such deals, helping acquirers negotiate terms with suppliers and improve cash flows. Unlike stock-for-stock mergers or stock acquisitions, asset acquisitions are paid in cash rather than stock.

During asset deals, the parties involved negotiate an asset purchase agreement which outlines the purchased assets, liabilities to be assumed, warranties, representations, and closing conditions.

After the transaction, the seller typically retains the assets and liabilities not purchased by the buyer. Asset deals most commonly occur under the following circumstances:

- When buyers aim for specific business units, technologies, contracts, etc. while avoiding unrelated or underperforming parts of the sellers’ businesses.

- When sellers dispose of assets to reorganize operations

- When a seller is a limited liability company, due to protection of personal assets from the company’s liabilities.

Overview of stock acquisitions

A stock acquisition is when a buyer purchases stock from shareholders of the target company to gain an ownership interest in said company. This would involve purchasing a controlling interest (over 51% of shares).

After the transaction, the buyer becomes the owner of the target company and inherits all its assets and liabilities. Stock transactions and mergers are often paid with stock or a mix of stock and cash. An alternative to using cash to acquire stock is the stock-for-stock merger. What is a stock-for-stock merger? It’s when the target company’s stock is exchanged for stock of the purchasing company. Various types of stock transitions most commonly occur in the following scenarios:

- When buyers want to acquire targets as quickly as possible

- When buyers want to quickly expand market reach and diversify revenue streams as part of the business strategy.

- When buyers are private equity firms aiming to develop portfolio companies

Asset acquisition vs stock acquisition: Key differences

Let’s map the key differences and nuances of asset vs stock acquisition.

| Area | Asset acquisition | Stock acquisition |

|---|---|---|

| Ownership transfer | The buyer purchases individual assets. | The buyer takes ownership of the entire target business, including unwanted assets. |

| Seller’s status | The selling company remains an independent business and retains legal ownership. | The selling company is taken over by the buyer. |

| Liability considerations | The buyer assumes selected liabilities based on its risk appetite. | The buyer assumes all known, unknown or uncertain liabilities. |

| Execution complexity | An asset deal is complex and time-consuming due to appraisals, contract renewals, third-party consents, and operational disruptions. | A stock deal is less complex due to an all-in-one ownership transfer and operational continuity. |

Asset and stock deals can be very nuanced. Buyer and seller perspectives can be different, causing conflict. Let’s explore the contrasting buyer and seller visions of an asset purchase vs stock purchase, illustrated with a few real-world examples.

Buyer’s perspective

Risk management

The choice between asset vs stock purchase acquisition significantly impacts the buyer’s risk exposure. Buyers prefer asset purchases when dealing with high-risk targets, particularly if those companies are distressed. In contrast, targets that carry minimal financial implications may find their acquirers more willing to structure stock deals.

Integration

Buyers may choose stock acquisitions when pursuing an integration of operations, revenue streams, and employees. On the other hand, only integrating individual business units or certain assets into the acquirer’s operation is much more complex due to legal, operational, and infrastructural challenges.

Talent retention

Stock acquisitions ensure the smooth integration of employment agreements because workers don’t need to be rehired. That translates into greater talent retention when compared to acquisitions of separate business units. For that reason, stock acquisitions are also preferable for sector-focused buyers hunting for unique talent.

Seller’s perspective

Transaction value

Stock acquisitions are the best way for sellers to maximize valuations because buyers typically pay a premium to incentivize selling shareholders and outbid competitors.

Asset sales generally make sellers attempt to maximize the price, particularly to cover higher taxes. However, individual assets are typically worth less when separated from the brand, its audience, and the existing business’s positive reputation.

Post-sale liabilities

Sellers generally want to limit their liabilities and shift as many obligations to buyers as possible. In that regard, stock acquisitions are the best option. Full ownership transfer paves the way for a cleaner exit, allowing the old owners to potentially cut all the ties with the sold business. Asset acquisitions, on the other hand, make the status of original owners’ more complex as they now own fewer assets and therefore have less financial power to cover existing liabilities.

IBM and Weather Company

IBM’s acquisition of the Weather Company’s assets exemplifies the buyer’s selective approach to a stock vs asset purchase decision. By structuring this transaction as an asset purchase, IBM hand-picked attractive assets and excluded non-desirable liabilities. The tech giant acquired weather.com, The Weather Channel, and Weather Underground mobile apps, for $2 billion in 2016.

IBM’s rationale was to acquire the Weather Company’s weather data technology to improve its Watson data analytics engine. Additionally, it aimed to capitalize on viewers choosing digital weather apps rather than TV forecasts. For instance, the Weather Channel mobile app gave IBM access to 66% of U.S. consumers.

Had IBM opted for a stock acquisition, it would have also acquired the Weather Company’s declining TV business (As evident from Comcast’s investment in the company, which devalued from $335 million at the end of 2014 to $81 million in 2015). Moreover, TV was out of IBM’s computing and software scope.

Disney and Pixar

Disney acquired Pixar for $7.4 billion in 2006 in an all-stock deal. Disney sought Pixar’s innovative culture and the breakthrough 3D animation technology. The potential was clear. Toy Story, the first full-length fully 3D-animated movie, grossed $394 million worldwide with a $30 million budget.

Disney acquired Pixar to retain its business continuity and reap huge profits. In turn, Pixar benefited from Disney’s movie distribution capabilities.

It was a win-win vertical merger that translated into around $11.5 billion generated at the global box office post-deal. Furthermore, this stock deal secured strong returns for Steve Jobs, Pixar’s major shareholder.

Jobs, who owns about 50 percent of Pixar (Research), would want a strong premium to its current $5.9 billion market capitalization to consider a sale.

CNN Money

Had Disney chosen an asset deal, it would have disrupted a highly successful animation studio with unique technology and priceless talent. Moreover, the asset acquisition would have been very complex, considering contracts, intellectual property rights, and technology appraisals.

Asset transaction: Pros and cons for buyers and sellers

Asset and stock acquisitions carry varying advantages for buyers and sellers. What’s more important, what is good for a buyer is often bad for a seller and vice versa. Let’s explore those benefits and drawbacks to understand why buyers and sellers often have conflicting goals.

Pros for buyers

Greater negotiation power

When disposing of assets, sellers are usually motivated to improve financials and free up resources for core operations. In a buyer’s market, that gives acquirers greater negotiation power. Buyers can also execute the “right of offset” – they can recover losses when sellers breach warranties or representations outlined in the purchase agreements.

A ‘right of offset’ allows the buyer to unilaterally offset from future payments due the seller the amount of any damages suffered by the buyer in the event something is wrong with the acquired business in contravention of any warranty and representation made by the seller.

Robert M. Mendell

Attorney at Law

Fewer HR hurdles

A buyer has full control of what happens to employees after the acquisition, especially the workers of the target company. For instance, an acquiring company can avoid financial outlay in the event of layoffs. The responsibility for paying unemployment benefits remains on the seller.

Fewer antitrust concerns

An asset purchase transaction doesn’t impact ownership interest in a target company, nor does it result in a takeover or significant change in market control. Because asset deals don’t threaten market competition as much as stock deals do, they are less likely to be blocked by regulators. Such deals are also easier to execute from a securities law perspective.

Drawbacks for buyers

Administrative hurdles

Buyers must create subsidiaries after asset purchases outside their existing operations. The necessity to obtain business licenses and permits, rewrite contracts, and reorganize inventory can delay profit generation from acquired business units or individual assets.

Higher asset prices

Buyers may pay higher premiums embedded in asset prices because sellers want to cover high taxation costs. That is more common with a C corporation that pays double taxes.

Benefits for sellers

Strategic adaptability

An asset sale helps a company adapt to market changes. For instance, IBM sold Watson Health to streamline operations and channel its efforts into artificial intelligence.

A clear next step as IBM becomes even more focused on our platform-based hybrid cloud and AI strategy.

Tom Rosamilia

Senior Vice President and Senior Advisor at IBM

Less dependence on shareholder approvals

Shareholder approval is not required in asset sales unless such sales constitute “all or substantially all” assets under DGCL Section 271. However, US state law doesn’t specifically define the notion of “all or substantially all” assets. Rather, it considers qualitative and quantitative measurements.

That opens the possibility for the seller to bypass shareholder approval even when major assets are sold, as demonstrated by legal cases. For instance, the Altieri v. Alexy case illustrates that, under specific circumstances, a company can divest assets totaling over 50% of its revenue without shareholder consent.

…the court held that it did not support a conclusion that Mandiant had sold substantially all of its assets. Even though the sale was for $1.2 billion, the FireEye business comprised only approximately 38% of Mandiant’s total assets.

Thomas E. Johnson

Managing Associate at Sidley Austin LLP

Drawbacks for sellers

An asset deal is generally less favorable for a seller due to immediate tax consequences, the complexity of asset transfers, liability retention, and operational disruptions. Asset sellers typically have less negotiation power and must carry the responsibilities of warranties and representations that favor buyers in the first place.

Stock purchase: Pros and cons for buyers and sellers

Stock acquisitions may offer more benefits than drawbacks to both the buyer and seller, which explains their popularity in the M&A landscape. Let’s explore the key aspects for both parties.

Benefits for buyers

Fast business growth

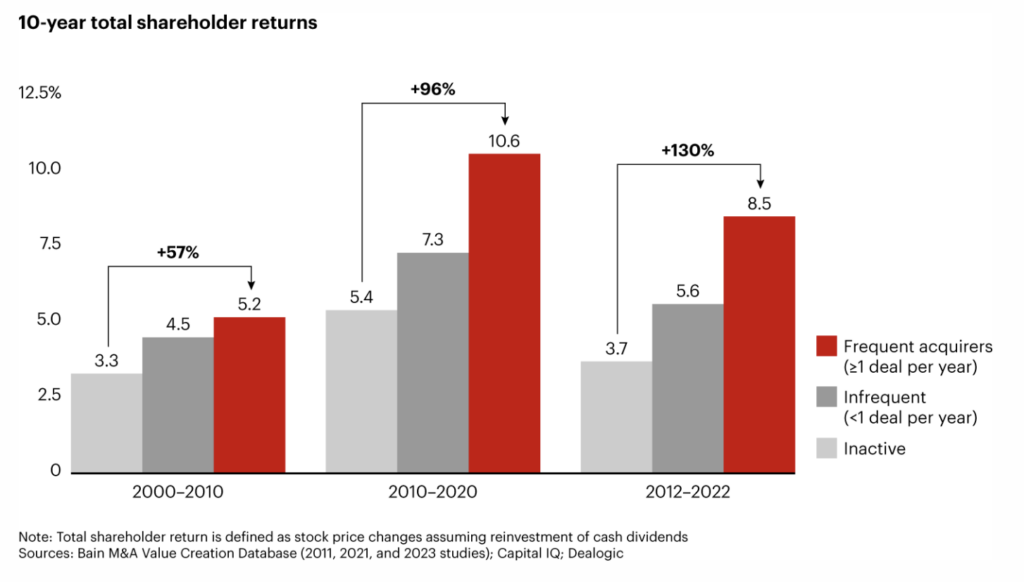

M&A analysis confirms that acquisitions work much better than organic growth. According to Bain & Company, acquirers enjoy 130% higher shareholder returns than companies not engaged in acquisitions. However, when comparing a stock vs asset acquisition, buyers should consider that stock purchases have a higher chance of delivering strategic benefits and strong shareholder returns. That is because, when fully acquiring other companies, buyers can quickly amass customers, broaden market reach, capture technologies, and reduce competition.

Preservation of business identity

Stock buyers often preserve the business identity of target companies, which offers greater strategic freedom and unlocks more long-term opportunities.

Facebook’s acquisition of WhatsApp can illustrate how preserving its identity helped Zuckerberg dominate social media — WhatsApp reached 2.4 billion users in 2023.

Drawbacks for buyers

Regulatory scrutiny

Regulators cancel about each year to prevent mergers from forming monopolies and threatening market competition. Amazon’s termination of a $1.7 billion acquisition of iRobot was among numerous regulatory interventions of 2024. Stock deals must also comply with federal securities laws and require more detailed disclosures.

Hostile shareholders

A stock transaction is of no concern for the target’s majority shareholders but may turn its minority shareholders hostile if they have a different perception of the stock purchase agreement. While minority shareholders have little power to block the sale, they may attempt to complicate the transaction by filing lawsuits.

Can a shareholder be forced to sell shares? Discover the nuances of shareholder relations in stock deals in our dedicated article.

Benefits for sellers

Buyer competition

A startup can secure a higher business valuation in the seller’s market. Facebook’s acquisition of Instagram is one of the best examples. Despite having only 13 employees and generating zero revenue, Instagram negotiated a $1 billion cash and stock sale, particularly due to a $500-million bid made earlier by Twitter, Facebook’s competitor.

The Instagram acquisition was all about combating rivals Twitter and Google+ and boosting its strategy on mobile, the sources said

Salvador Rodriguez

Tech Reporter for CNBC.com

Drawbacks for sellers

The risk of assuming unknown liabilities from stock sellers makes buyers more cautious. That often translates into higher holdback amounts. A holdback is a buyer’s emergency fund consisting of 5%–20% of the stock deal price left in escrow for several months and even a few years after closing. Acquirers may also negotiate price adjustments upon revealing additional risks, such as when normalized net working capital doesn’t match the agreed value. These factors may erode some value from stock sellers.

Stock vs asset acquisition: Tax considerations

Let’s discuss tax advantages and tax implications for buyers and sellers in asset and stock acquisitions.

Asset acquisitions

Buyer’s tax

Asset acquisitions are generally more beneficial to buyers from a tax perspective. Buyers can adjust the cost basis of acquired assets to the fair market value rather than what is reflected in the sellers’ books.

This stepped-up tax basis allows buyers to make higher depreciation deductions and reduce income taxes. The buyer’s benefit from significant tax deductions can be up to 25% of the difference between the purchase price and the target’s tax basis.

Seller’s tax

Sellers are subject to different tax treatment based on the nature of sold assets. Tangible assets, like hardware, machinery, or equipment, are taxed at the ordinary income rate. In contrast, intangible assets, like goodwill, are taxed at a lower capital gains rate.

However, asset deals are still less preferable for sellers, particularly C-corporations, because state laws impose sales taxes leading to double taxation. First, the company is taxed on the corporate level (ordinary income and corporate capital gains). Second, the target company’s shareholders are taxed at a capital gains rate when receiving transaction proceeds in the form of dividend payments.

Stock acquisitions

Buyer’s tax

Stock acquisitions are less favorable for buyers from a tax perspective. Buyers cannot benefit from stepped-up tax basis in stock deals during the transfer of ownership. Still, acquirers can counteract that by inheriting sellers’ tax attributes, such as net operating losses (NOL), but only to the extent outlined under IRS Section 382.

Seller’s tax

Stock acquisitions are preferable for sellers for tax purposes. They are tax-neutral at the corporate level. That is because the target company doesn’t technically profit or lose anything from the successful transaction because it occurs at the shareholder level.

Consequently, corporate-level taxes are not charged from the stock sale. Instead, the shareholders of the selling entity are taxed at a lower capital gains rate. This peculiarity also helps the seller to ensure an easier exit when they transfer taxes and associated liabilities to the new owner.

Discover acquisition vs IPO exit options in our dedicated article.

Tax-free reorganization

When structured as a reverse triangular merger, a stock acquisition falls under the criteria of a tax-free reorganization under IRC Sections 368(a)(1)(D). It allows shareholders of the target company to defer tax liabilities until they, for instance, sell shares received in the transaction.

Final words

- Buyers prefer asset acquisitions for the ability to acquire assets selectively, limit liabilities, like long-term debt obligations, and gain tax benefits.

- Sellers prefer stock acquisitions for higher valuations in the seller’s market, tax efficiency, and the ability to transfer liabilities. Stock acquisitions can also qualify as tax-free reorganizations, offering tax-deferral benefits to the owners and investors of selling companies.

- Stock acquisitions offer business continuity and are easier to execute than asset deals which typically require contract adjustments and time-consuming asset appraisals.

- Stock transactions are the most common form of M&A deals and help both buyers and sellers to survive competition and accelerate business growth.