Despite volatility in the capital markets, IPOs remain one of the fastest and most compelling ways to raise funds.

With the uncertainty of market recovery looming over investors and executives, 2022 has seen a 41% global decrease in IPO volumes and a 57% decrease in IPO values year-over-year.

Considering the current landscape, we will continue to bring you insights as events unfold.

IPO trends 2022

According to Paul Go, the EY global IPO leader, the main IPO trends for 2022 were the following:

- Decrease

There were 992 IPOs raising $146B in proceeds, reflecting decreases of 44% and 57%, respectively, year-over-year.

- Technology sector

The technology sector continued to lead by number, but the average IPO deal size decreased from $261m to $123m.

- Energy sector

The energy sector was the top IPO fund raiser with an average deal size increase of 176%.

- Consumer products sector

Consumer products sector saw a most significant decrease in average deal size of 69%.

- 10 largest IPOs

The 10 largest IPOs by proceeds raised $40B, with energy dominating three of the top four deals.

Compared to 2021, which was a record-breaking year for IPO, 2022 experienced a dramatic slowdown. Here are some fuels and outcomes from such a dramatic decline of the IPO market:

- Skyrocketing inflation

The global inflation surge made central banks hike interest rates and tighten monetary policy.

- Increased volatility

Heightened volatility caused by macroeconomic factors, Russia’s invasion of Ukraine, and other geopolitical strains decreased IPO activity significantly.

- Lockdowns in China

Dozens of Chinese companies suspended their planned IPOs because of the restrictions and inability to complete due diligence.

- Poor performance of companies that went public in 2021

80% of IPO stocks from 2021 were trading below their offer prices. The return of offerings from 2021 was minus 30%.

- Fall of the SPAC market

The number of IPOs by special purpose acquisition companies (SPACs) decreased to the level of 2016 and 2017.

Note: Learn what is a merger arbitrage in our dedicated article.

IPO trends in H1 2022

Let’s take a closer look at the IPO trends of the H1 2022.

General overview

The global IPO activity in the first half of 2022 was characterized by:

- Geopolitical uncertainty

- Market volatility

- Growing concerns about the rise in prices for commodity and energy

Now let’s focus more on what was happening with public markets and the global IPO activity in Q1 and Q2 separately.

As of Q1 2022, there were 321 IPO deals with $54.4 billion of IPO proceeds raised in total. This is a decline of 37% and 51% respectively compared to the same period in 2021.

Paul Godescribed the IPO sector of Q1 2022 as follows: “A decrease in IPO activity was not unexpected when compared with Q1 2021 as the latter was the most active quarter in the last 21 years. However, the market shock from geopolitical tensions and other economic concerns in the second half of the quarter created volatility and impacted the capital markets.”

Also, two other important trends emerged in Q1 2022:

- The biggest number of IPOs took place in the technology and materials sectors with 58 deals (18% of global IPOs) in each sector. The total IPO proceeds were estimated at $9.9 billion in the technology sector and $5.9 billion in the materials sector.

- The energy sector led by proceeds with $12.2 billion.

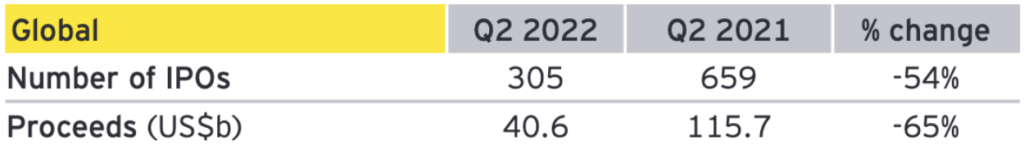

As of Q2, the IPO sector saw 305 IPOs with $40.6 billion of proceeds in total. This is a 54% and 65% decline compared to the same period in 2021.

There are a few more facts about IPO sectors in Q2 2022 that are worth to mention:

- Many IPO deals were postponed because of increasing market volatility.

- The overall decline in IPO activity was typical for all major markets.

- IPO markets of the Middle East and India demonstrated the best performance.

Geographical peculiarities

A brief look at the IPO H1 2022 activity around the world across most major markets outlined the following scenario.

Americas

- The Americas market saw the biggest drop in deal numbers: 80% less than the same period in 2021.

- SPAC IPOs represented half of the activity. There were 17 deals and $2.2b of proceeds.

- The finance sector dominated and took up about 35% of all IPOs. It was followed by the health technology sector, which took approximately 20%.

Asia-Pacific (APAC)

- Almost 50% of all deals in the global IPO market were completed in the Asia-Pacific region, making it the most active worldwide.

- The activity was mainly driven by India and China IPO where over 90% of total Asia-Pacific proceeds took place.

- The most active sectors were biotech, health care, and technology.

Europe

- The European IPO market was largely closed for most issuers. It represented 15% of global IPO deals and 4% of proceeds.

- Italy saw the most activity in IPO as a chemicals company raised $500M by going public.

- The UK experienced a 71% decline in volume and 99% in proceeds, having 13 IPOs that raised $149M.

The Middle East and North Africa (MENA)

- Despite the tensions in the global economy, the MENA region saw a 500% year-over-year increase in the number of companies going public.

- There were 15 IPOs in Q1 2022 and nine IPOs during Q2 2022 that together raised about $13B.

- UAE and Saudi Arabia dominated IPO activity. UAE experienced its largest IPO in its history with DEWA raising $6.1B.

IPO trends in H2 2022

Below are key highlights of IPO markets in the second half of 2022.

General overview

First, let’s define the main characteristics of H2 2022:

- Strong headwinds such as declining valuation, skyrocketing inflation, the weak performance of capital markets, and geopolitical tensions continued to prevent companies from going public.

- Mainland China and the Middle East were more attractive to investors in comparison with other regions.

- The green energy sector led by proceeds from bigger deals as oil prices were skyrocketing. It made people switch to renewable sources of energy faster.

- The technology sector continued to lead in terms of deal number as more technology companies were looking for platforms that can offer consumers a wider range of services.

- ESG remained a core value for investors and IPO candidates. Companies committing to make the world a better place and incorporating ESG (environmental, social, and corporate governance) values in their culture attract more investors.

A brief analysis of the IPO stock market in Q3 and Q4 of 2022 reveals that, as of Q3 2022, there were 991 IPOs with $146 billion in IPO proceeds raised in total. Among other trends of Q3 2022 are the following:

- Market uncertainty

IPO investors and companies were facing market uncertainty, macroeconomic challenges, increased market volatility, and falling global equity prices.

- Market volatility

Market volatility increased from 19.7 in 2021 to 25.6 in 2022 compared to the same period.

- Technology sector

In Q3, tech companies were leading by the number of global IPOs, despite the average deal size being $123 million compared to $261 million in Q3 2021.

- SPAC

The Q3 2022 has also witnessed the lowest SPAC IPO proceeds since Q3 2016: there were only 17 deals raising $0.9 billion.

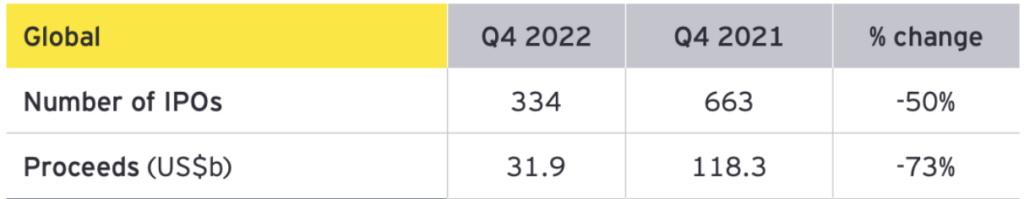

As of Q4 2022, there were 334 IPOs with $31.9 proceeds, which is a significant decline of 50% and 73% respectively compared to Q4 2021.

The Q4 of 2022 was also characterized by the fact that:

- It was the Q4 with the lowest rates by the number of deals and proceeds for more than 10 years.

- Despite the sharp decline in global IPO activity compared to the previous year, there still were some bright spots: Japan, for example,has completed its largest IPO of the year and there was a slew of listings in Saudi Arabia.

Geographical peculiarities

Below are the key H2 2022 IPO statistics across major markets.

Americas

- In Q3, the American market saw the most significant decline in the IPO activity — 116 deals raising $7.5 billion in proceeds. This is a 72% and 94% decrease compared to the same period in 2021.

Q4 figures were even worse — 16 IPOs with $1.5 billion of proceeds in total. This is an 86% and 96% decline respectively year-over-year.

5 largest IPOs in 2022

1. LG Energy Solution Ltd

LG Energy Solution is a South Korean eco-friendly battery company. It created Korea’s first lithium-ion battery in 1999. Later, it became a supplier to global car producers, such as Audi, Volvo, Ford, Chrysler, and Renault.

In the first quarter of 2022, the company had the largest IPO worldwide and raised about $10.7B. Its shares surged 68% on the first day and 40% in a month after it went public.

Now LG Energy Solution is worth over $98 billion which makes it the second-largest Korean company after Samsung.

2. Dubai Electricity & Water Authority (DEWA)

The Dubai Electricity & Water Authority (DEWA) is a public service infrastructure company formed in 1992 by the merger of the Dubai Electricity Company and the Dubai Water Department. Both organizations were founded by Sheikh Rashid who ruled Dubai at that time.

Today DEWA provides electricity and water to almost 1 million customers with a happiness rate of about 95%. It’s also ranked as one of the best utility companies in the world.

After it went public, the company’s shares jumped 16% on the first day and 10% in a month.

Today this is the largest listing in the UAE, having raised $6.1B. Besides, this is the largest listing in the Middle East since the IPO of Saudi Aramco, a Saudi Arabian oil company that raised $25.6B in 2019.

3. Jinko Solar Co Ltd

Jinko Solar is a Chinese solar panel manufacturer based in Shanghai. The business focuses on the research and development of photovoltaic products and clean energy solutions. The company serves more than 3,000 customers and markets its products worldwide in 160 countries.

Jinko Solar was listed on the STAR Board of the Shanghai Stock Exchange in January 2022. It’s the second largest IPO in the first quarter of 2022.

The organization raised $1.6B and showed an excellent after-market performance. It closed 111% above the issue price on the first day of trading and 132% one month after it.

4. Life Insurance Corp of India

Life Insurance Corporation of India (LIC) is an insurance and investment company. It was founded in 1956 and is owned by the Indian Government. It’s the most trusted insurance company in the country with over 250 million customers.

It went public in May 2022 and raised $2.7B, breaking India’s record as the country’s biggest IPO. It also became the fourth-largest IPO in the world in 2022.

But a record-breaking and oversubscribed IPO raised far less than the government expected. LIC’s shares slid nearly 8% in its market debut. And since May, the shares have plunged 29%. India’s biggest-ever IPO now ranks second in terms of market capitalization loss.

5. Borouge

Borouge is a provider of innovative polyolefin solutions and produces plastics for manufacturing and consumer goods. The organization was founded in 1998 and now supplies polyolefin to customers in 50 countries across the Middle East, Asia, and Africa.

In May 2022, the company was listed on the Abu Dhabi Securities Exchange and became Abu Dhabi’s largest IPO, raising $2B.

The shares surged 22% on the first day of trading, valuing Borouge at $24B. It made Borouge the sixth largest company on ADX.

IPO trends YTD 2023

Now, let’s overview the state of the IPO market in the first half of 2023, according to Ernst & Young.

- By the first half of 2023, there were 615 IPOs with $60.9 billion of capital raised. This is a decline of 5% and 36% respectively compared to the same period year-over-year (YOY).

- The technology sector continued to lead in the IPO activities by the number of deals and proceeds raised.

- Due to the lower global energy prices, IPO proceeds received by the companies in the energy sector declined as well.

- The American IPO market has experienced an 86% increase in proceeds, raising $9.1 billion YOY. Such an improvement in market sentiment could be a sign of better IPO activity in late 2023 or 2024.

- The Asia-Pacific IPO market has been a leader in IPO volume and share, with about 60% share.

- The European IPO market has seen very limited activity so far, mainly due to the volatility in the banking sector.

- Some of the emerging markets such as India and Indonesia were flourishing with IPO activity thanks to the increased global demand for mineral resources and a growing number of SMEs and unicorns.

- Most large IPO deals took place in Mainland China and one in Japan.

Note: If your company is about to go through IPO, explore IPO preparation steps given in our dedicated article.

Key takeaways

- There’s a considerable decline of 44% in the number of IPOs and a 57% drop in proceeds in 2022, in contrast to IPO trends 2021.

- The main reasons for the decline are COVID-19 restrictions, the Russian invasion of Ukraine, geopolitical uncertainties, economic tension, and rising interest rates.

- The technology sector led by deal number, and the energy sector led in proceeds.

- The Americas and Europe markets recorded the most considerable decline in 2022, while MENA and the Asia Pacific regions were the most active in terms of volume and number of IPOs.

- The five largest IPOs in 2022 were LG, DEWA, Jinko Solar, Life Insurance Corp of India, and Borouge.

- The first half of 2023 has experienced 615 IPOs with $60.9 billion of capital raised so far.

Guide on going public

Preparation is prized in the IPO market, and starting early is crucial to success.

To support executives during this stage, the M&A Community, in collaboration with iDeals, published the IPO Consideration Stage white paper, painting the full picture of the key points to consider before deciding to go public while doing so is still under evaluation.

Download the whitepaper here.