M&A practitioners attribute deal failure to many factors: from poor cultural fit to unclear strategy and a lack of senior management commitment. What unites all these risks is that they can be mitigated with a well-planned and managed M&A pipeline.

Moreover, the M&A deal pipeline helps dealmakers gain competitive advantages and achieve better synergies, such as cost and revenue synergies.

This article dwells on the M&A pipeline’s meaning, its key stages, and potential challenges. Additionally, we provide recommendations on how to build an M&A pipeline and share the best practices. Keep reading.

What is an M&A pipeline?

M&A pipeline (sometimes referred to as M&A funnel) refers to the sequence of events happening during the M&A process.

In other words, the M&A pipeline comprises all the main stages of an M&A lifecycle: from strategy development to post-merger integration.

For a serious strategic acquirer, building a strong M&A pipeline makes absolute sense and is something that senior management needs to constantly spend time on. At the end of the day, deals are not only about numbers and spreadsheets, but about people and relationships as well.

Christopher Kummer

Founder and CEO of IMAA

By implementing a well-planned and managed M&A pipeline, dealmakers ensure that the complex M&A process is streamlined, all participants know their areas of responsibility, and all the stages have clear timelines, objectives, and key success metrics.

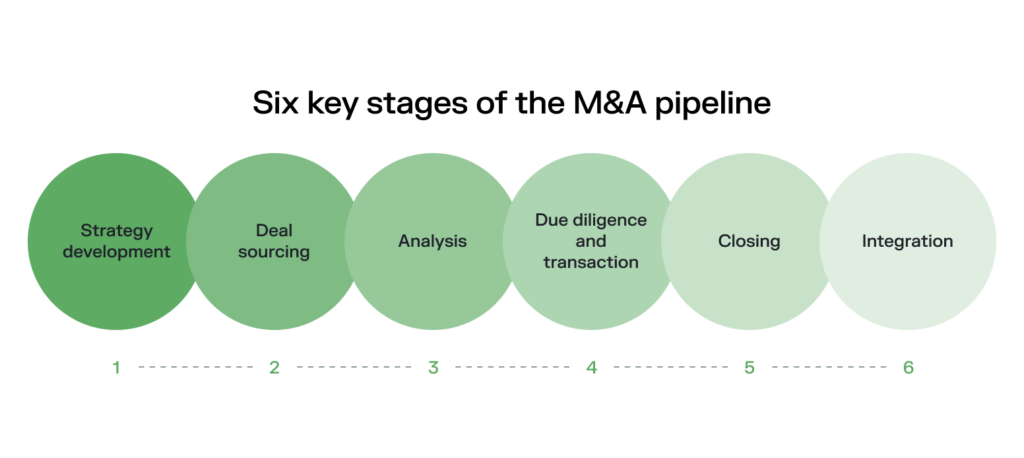

Six key stages of the M&A pipeline

Let’s now take a closer look at the main M&A pipeline stages. Typically, there are six of them.

1. Strategy development

M&A pipeline steps begin with the acquisition planning and development of an acquisitions strategy that involves defining the objectives and criteria for potential acquisitions.

This stage includes aligning the M&A strategy with the overall corporate strategy, identifying target sectors, and establishing the financial and strategic goals. It helps to define the companies fit to be targeted and the expected outcomes from the potential acquisition.

Additional reading: Learn the main specifics of defining the right M&A strategy for your transaction in our dedicated article with M&A strategies examples.

2. Deal sourcing

Based on the clearly defined M&A strategy, the buy-side of the M&A process then searches for the most appropriate and fruitful targets.

This involves networking, market research, and leveraging financial advisors or brokers to find suitable companies that meet the pre-defined criteria. The goal is to create a list of viable candidates for further evaluation and for the potential deal moving forward.

3. Analysis

This stage includes initial data requests from the potential target and their further analysis.

Initial data request implies analyzing the target’s business model, financial modeling, market position, and strategic fit. The objective is to identify the best prospects that align with strategic goals and financial expectations.

4. Due diligence and transaction

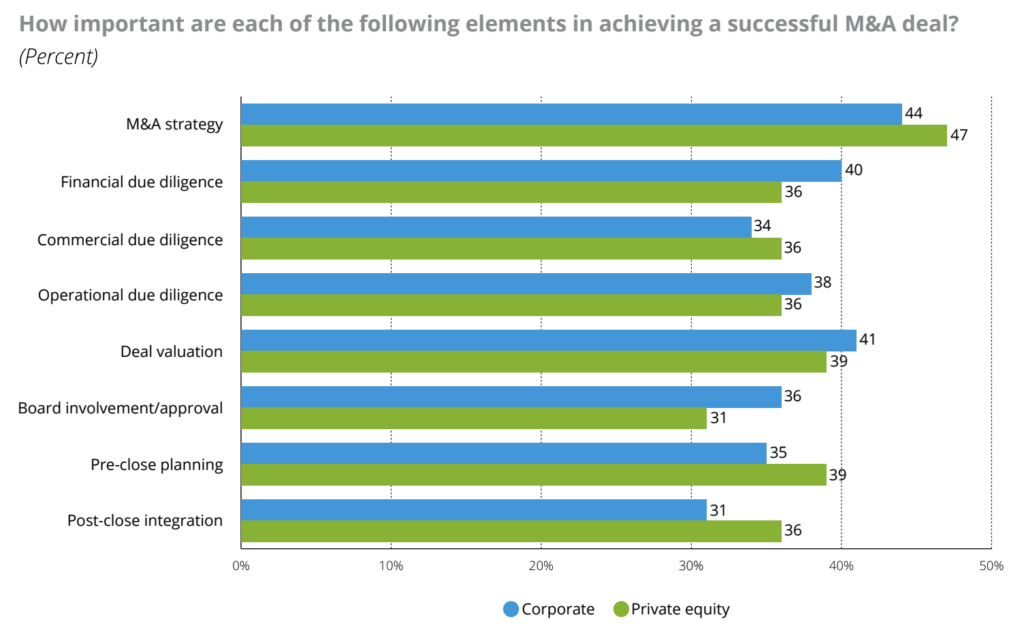

Based on the previous stage findings, the buyer decides on the best candidate and proceeds with due diligence, one of the most important factors in achieving the deal’s success.

Unlike preliminary analysis of the target that provides just a brief overview of its operations, due diligence allows seeing both the big picture and tiny details of data that are not publicly available.

The due diligence process involves thoroughly investigating a target company’s business, including legal, financial, and operational aspects, to confirm all material facts and assess risks.

Once due diligence is satisfactory, deal teams negotiate transaction terms and draft and sign definitive agreements.

Note: At this stage, the deal team often uses dedicated M&A deal management or project management software that enables a collaborative and efficient process and offers various project management features to track deal progress.

5. Closing

Closing is the final step where the transaction is officially completed. It involves finalizing all legal documents, transferring ownership, and ensuring all conditions are met. Funds are transferred, and the target company’s control is handed over to the acquirer.

6. Integration

Integration is the process of combining the operations, cultures, and systems of the acquired company with the acquiring company.

This stage focuses on realizing the synergies identified during the earlier stages and ensuring a smooth transition. Effective integration is crucial for achieving the strategic and financial objectives of the acquisition.

How to build a robust M&A pipeline in 10 steps

Considering the main stages of the M&A pipeline, below are the common steps a dealmaker should take for a strong and effective pipeline development and deal flow improvement.

The first step is to clearly understand the acquisition’s motive and include it in the M&A strategy. It could be market expansion, diversification, acquiring new technologies, or increasing market share.

This includes determining key metrics for the potential strategic fit identification. Such metrics can include financial, operational, and cultural specifics: from revenue, EBITDA, and profit margins to geographical presence, customer base, and cultural values.

To proceed with deal sourcing, you first need to make up a team of responsible specialists. The deal team usually comprises internal employees and outside financial advisors and brokers. Together, they perform market research and attend industry conferences, trade shows, and networking events to identify potential targets and build relationships.

Use databases, market research reports, and competitive analysis to compile a list of potential targets. Rank targets based on strategic fit, financial health, and acquisition feasibility.

Once you have the list of potential targets, approach prioritized ones to assess their interest and obtain preliminary information. Based on the received data, perform initial financial analysis, market assessment, and strategic fit evaluation.

Having decided on the best fit, conduct thorough due diligence covering financial, legal, operational, and technological aspects. Additionally, evaluate the target go-to-market position and determine its true value using various valuation methods (DCF, comparables, precedent transactions). Finally, identify potential risks and mitigation strategies.

If the due diligence results are satisfactory, plan for post-acquisition integration, covering operational, cultural, and structural aspects. Identify and quantify synergies, and develop a detailed plan to achieve them.

Determine how the acquisition will be financed (cash, stock, debt, or a combination) and engage with financial institutions or investors to secure necessary funding.

Negotiate terms and conditions, focusing on price, representations and warranties, indemnities, and other key terms. After this, draft and finalize the purchase agreement and other legal documents.

To successfully finalize the deal, execute the pre-made integration plan, ensuring clear communication and alignment across teams. It’s also essential to continuously monitor performance against pre-defined metrics to ensure the acquisition achieves the desired outcomes.

Best practices for managing the M&A pipeline effectively

M&A pipeline management is about the M&A process optimization and ensuring a smooth transition between each stage. Below are several core recommendations to manage M&A deal flow effectively:

- Start integration planning early

One of the critical integration practices includes developing integration plans early, ideally during the due diligence stage. Such a structured approach allows for timely addressing of potential challenges and ensuring a smooth transition post-acquisition. - Ensure strategic communication transparency at all levels

Maintain open and clear communication with all stakeholders – including employees, customers, integration team members, and investors – to manage expectations and foster trust. - Use pipeline management software

Choose an M&A pipeline management software to track and manage the transaction efficiently, ensuring visibility and organization throughout the process. What’s more, modern lifecycle management software allows for navigating multiple deals at once. This makes them perfect for cooperation with several potential targets during the due diligence phase, for example. - Track company personnel risks

Any disruptions in the M&A pipeline are often caused due to certain personnel issues. Identify and assess key personnel risks to mitigate potential disruptions and ensure continuity in leadership and operations post-acquisition.

M&A pipeline challenges

Now, let’s briefly review the main challenges that occur during M&A pipeline management and suggest possible solutions to them.

Deal stagnation

The deal execution can often take too long and even stall at some point. The reasons are generally prolonged decision-making, lack of consensus among stakeholders, or market uncertainties.

Possible solution

- Establish clear timelines and milestones

- Assign a dedicated deal corporate development team to keep the momentum

- Maintain open and frequent communication with all stakeholders

- Streamline decision-making processes and obtain necessary approvals in advance

Inadequate due diligence

Insufficient due diligence can lead to overlooking critical risks, resulting in overvaluation or missed liabilities. Moreover, poor due diligence is among the main reasons for deal failure, according to Bain.

Possible solution

- Implement comprehensive due diligence checklists covering all critical areas

- Involve cross-functional teams (legal, financial, operational, and cultural) in the due diligence process

- Use third-party experts for specialized areas

- Conduct multiple levels of review to ensure thoroughness

Misalignment of strategic objectives

Sometimes differences in strategic goals and priorities can occur between the acquiring and target companies. This can create tension and hinder the deal’s success.

Possible solution

- Clearly define and communicate the strategic objectives of the M&A

- Ensure alignment through pre-merger discussions and negotiations

- Develop a shared vision and integration plan that aligns with both companies’ goals

- Engage senior leadership from both sides to foster alignment and commitment

Synergies overvaluation or underestimation

Overvaluation or underestimation are also common reasons for a deal’s failure. Overestimating synergies can lead to unrealistic expectations while underestimating them can result in missed opportunities.

Possible solution

- Conduct a detailed and realistic analysis of potential synergies

- Use historical data and benchmarks from similar deals for correct estimation

- Develop a robust integration plan to realize identified synergies

- Monitor and adjust synergy targets post-merger based on actual performance

Key talent loss

A company can often lose key employees during or after the M&A process due to uncertainty or dissatisfaction, impacting the combined entity’s performance. In fact, the inability to retain key talent is a reason for deal failure in 20% of cases.

Possible solution

- Identify and prioritize key talent early in the process

- Develop retention plans, including incentives and clear communication of employee’s role in the combined company

- Foster a positive and inclusive culture that values employees from both organizations

- Provide clear career development opportunities and support during the transition

Key takeaways

Let’s summarize the main points from the article:

- The M&A pipeline is a flow of events that occur during mergers and acquisitions.

- Dealmakers define six main stages of the M&A pipeline: strategy development, deal sourcing, analysis, due diligence and transaction, closing, and integration.

- Among the challenges that can take place in the M&A pipeline management process are deal stagnation, poor due diligence, misalignment of strategic objectives, overestimation or undervaluation, and loss of key talent.