The recent downturn in M&A activity has increased competition among dealmakers, pushing them to look for innovative approaches to succeed in dealmaking.

Technology has played a significant role, helping M&A practitioners become more efficient and create new opportunities. According to one survey, 74% of CEOs see technology integration in M&A as a growth driver and a source of competitive advantage.

In this article, we look at how M&A technology tools and services can be used during transactions. Continue reading to explore the top 12 merger and acquisition software products.

What is M&A software?

M&A software tools are designed to facilitate and streamline various aspects of the merger and acquisition process. Such tools are used at different stages of a deal lifecycle to accelerate the process and reduce M&A failure rate.

Mergers and acquisitions software platforms are tailored to meet the needs of dealmakers specifically: from investment bankers and financial advisors to legal experts and corporate executives.

The primary objectives of M&A software are:

- Deal efficiency

M&A transactions involve many tasks, including due diligence, planning mergers and acquisitions strategies, financial analysis, documentation review, and stakeholder communication. M&A software aims to automate and simplify these processes, reducing manual effort and saving time.

- Deal accuracy

Any errors or oversights during the transaction can have significant financial and legal implications. M&A software helps ensure data accuracy by centralizing information, providing real-time updates, and enabling thorough analysis.

- Deal success rate

The ultimate goal of M&A software is to increase the success rate of transactions. By improving efficiency and accuracy, M&A software enhances deal execution, reduces risks, and enhances decision-making, thereby boosting the likelihood of successful outcomes.

The variety of modern M&A software solutions can be categorized into virtual data rooms, due diligence automation tools, financial modeling software, collaboration and project management tools, and AI analytics software. Let’s review a few examples of products in each category below.

Virtual data rooms

A virtual data room (VDR) is a secure cloud-based repository for sharing and storing sensitive data. It also offers a variety of collaboration tools for effective communication, as well as analytical tools that allow for tracking project progress.

Though they appear to have similar functionality to other cloud storage solutions, VDRs offer enhanced security features that ensure data confidentiality. That’s why they’re seen as a critical tool for complex financial transactions in M&A.

Top examples

Let’s now review the top virtual data room provider examples that are tailored for M&A.

iDeals

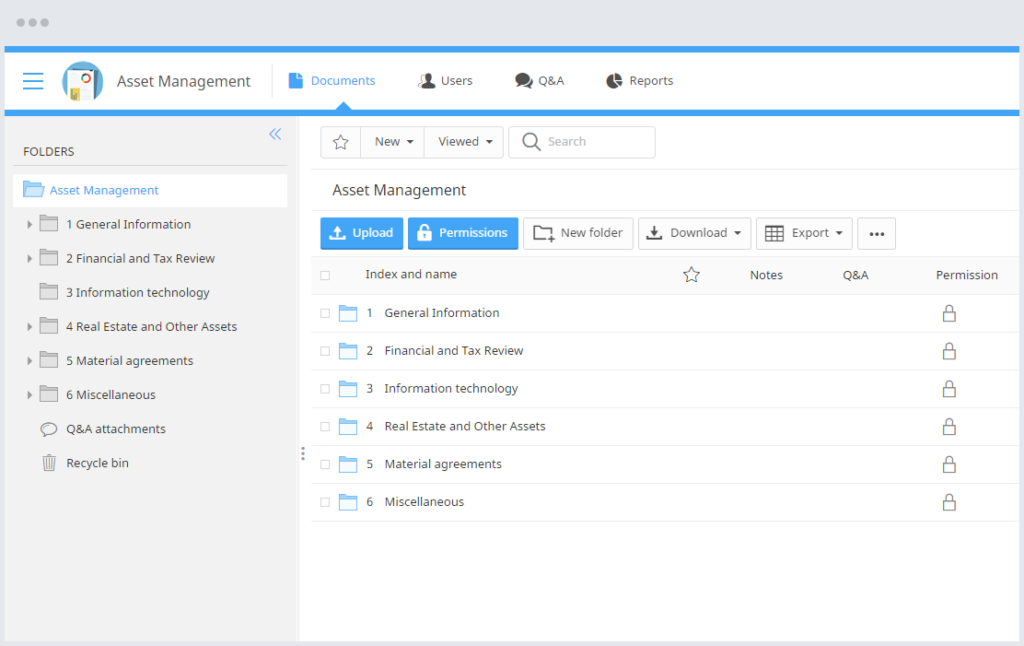

iDeals is a leading virtual data room provider with more than 15 years’ experience. It has assisted thousands of customers in running their high-value projects: from biotech product development to cross-border sales of multi-billion dollar assets.

iDeals places a focus on security, user experience, and customer service. It provides security features such as granular access permissions, in-built redaction, remote wipe, and user access expiration. iDeals also ensures that deal-makers can efficiently collaborate during all M&A process steps with the help of tools including dedicated Q&A sections, comments, and expert assignments.

Datasite

Datasite is one of the top global virtual data room providers targeted at deal-making specifically. It’s been on the market since 1968 and has served clients from 180+ countries. It’s tailored to M&A deals as well as other high-value transactions, such as restructuring, IPO, licensing, or fundraising.

The variety of features provided by Datasite is grouped into several products that aim to streamline M&A transactions: Datasite Pipeline, Datasite Intelligence, Datasite Diligence, Datasite Prepare, and others. Datasite offers training to new customers to help them overcome any issues with the platform.

SecureDocs

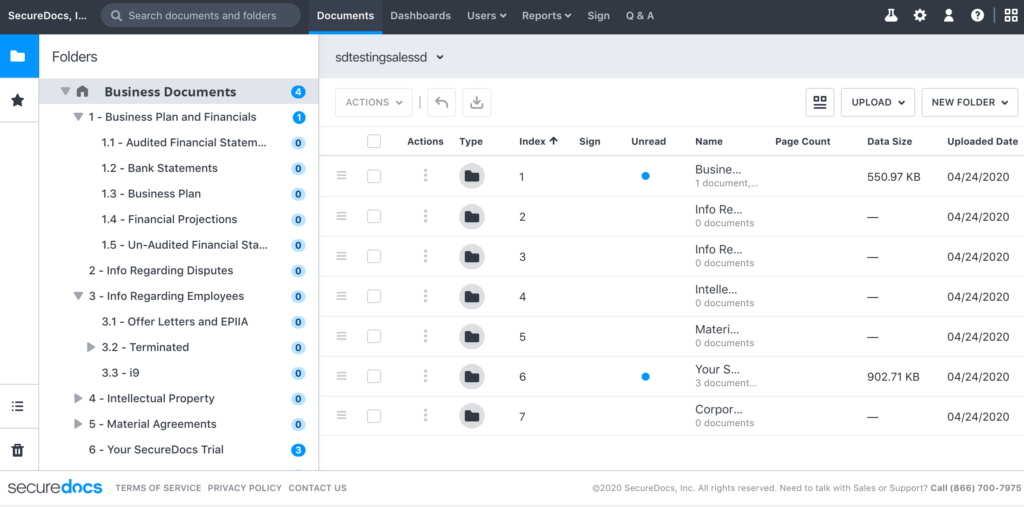

SecureDocs virtual data room is a product by Onit company, a service provider of automation tools for different business processes.

SecureDocs is widely used for fundraising, IPOs, mergers and acquisitions, strategic partnerships, bankruptcy, and other kinds of deals. It has assisted customers in about 122+ countries in completing deals for more than $100 billion.

Among the variety of features offered, SecureDocs streamlines M&A deals with such services as customizable dashboards and NDAs, audit log reports, permission-based user roles, and Q&As.

Due diligence automation tools

Due diligence automation tools are those that are tailored specifically to the needs of the due diligence process — they aim to simplify, automate, and streamline it.

Due diligence M&A platforms help with data collection, analysis, and processing, document review, risk assessment, compliance monitoring, workflow automation, auditing, and reporting. Additionally, such tools help with creating ready-to-use due diligence checklists.

Top examples

Let’s briefly review the top two examples of due diligence software.

Diligent

Diligent is a leading governance, risk, and compliance software as a service (SaaS) company. It offers various services for audit management, risk management, regulatory compliance management, board management, and due diligence.

Diligent is mostly used for conducting meetings, such as board meetings, as it provides opportunities for audio and video conferencing and other collaboration tools.

Kira Systems

Kira Systems is an AI M&A tool that helps professionals work on complex data. It analyzes different kinds of documents and contracts and extracts required information from them.

It’s a perfect solution for due diligence since this process presupposes working with large volumes of different data and Kira Systems significantly automates that process, and thus, saves time, resources, and money.

Financial modeling software

Financial modeling tools are indispensable during the M&A process. With their help, M&A practitioners significantly automate the process of financial modeling and streamline it.

Such tools can help with projection and forecasting, sensitivity analysis, evaluation, and capital structure optimization. They enable professionals to conduct rigorous analysis, make informed decisions, and structure transactions effectively, thereby maximizing value creation and minimizing risks in the deal-making process.

Top examples

Let’s now review a few examples of financial modeling software to use during M&A.

CapIQ (Capital IQ)

CapIQ (or Capital IQ) is a product of Standard & Poor’s (S&P), a global financial services company and a leading provider of ratings, research, and data analysis of the stock market and finance industry in general.

CapIQ is designed to assist investment professionals, corporations, advisory firms, private equity firms, and dealmakers in data aggregation and analysis, financial modeling, portfolio management, and market intelligence. The platform investigates financial news, company performance data, sector-specific data, and market insights to help users make the right investment decisions.

Eikon from Refinitiv

Eikon from Refinitiv (now LSEG) is a financial information platform designed for professionals in the finance industry, such as traders, analysts, and investment bankers. It provides access to real-time market data, news, analytics, and trading tools to help users make informed decisions and manage their investments effectively.

It aims to assist dealmakers in monitoring and analyzing their financial data. What’s more, Eikon also offers collaboration tools that allow connecting with trusted contacts in 30,000 firms around the world.

Collaboration and project management tools

Efficient collaboration among all the parties involved is an important factor behind a successful M&A deal.

That’s why dedicated collaboration and project management tools are so important during M&A. Such tools might not always be focused on M&A purely, but they ensure the quality of collaboration, efficient project management, and security of shared data.

Top examples

Let’s review three common collaboration platforms used during M&A transactions.

Asana

Asana is a modern project management and collaboration tool that allows teams of any size to effectively work on projects. Companies such as Japan Airlines, Figma, and Okta use Asana to manage projects of different sizes and objectives.

It offers various tools and features to ensure smooth team collaboration: from dashboards, tasks, and projects to timelines, charts, and in-app communication. Asana helps manage everything from company objectives to M&A process and product launches.

Trello

Trello is a global virtual collaboration tool used to bring teams together. It offers a variety of features for effective project management and collaboration. With its boards, lists, and cards, every project is broken into smaller tasks, which enables teams to productively and steadily work on the project completion.

Trello is one of the common M&A integration tools thanks to the collaboration possibilities it offers and its user-friendly interface. Deal participants can successfully collaborate on every deal’s stage and track the progress.

Microsoft Teams

Microsoft Teams is part of Microsoft 365. It’s a common collaboration tool that allows for effective communication between teams and secure file sharing.

Microsoft Teams offers chatting and video conferencing services that allow project participants to connect on important matters any time. Additionally, they can securely share and store files. What’s more, there are several AI-driven services, such as a writing assistant and chatbot (Microsoft Copilot) that can significantly automate the process of collaboration.

AI and analytics in M&A

AI-based analytics M&A tools improve deal tracking and deal analysis. What’s more, such platforms can help with predictive modeling, target identification and screening, valuation, risk assessment, synergy analysis, and integration planning.

Top examples

Let’s review a couple of examples.

Palantir

Palantir is an AI-powered software that helps companies with their data analysis and integration. It’s widely used in industries that deal with large volumes of complex data, such as government, healthcare, manufacturing, finance, and M&A, in particular.

Palantir’s main product is its data integration and analysis platform called Palantir Gotham. It is designed to help organizations make sense of large and disparate datasets by integrating them into a centralized platform, allowing users to analyze, visualize, and derive insights.

IBM Watson

IBM Watson is an AI platform that combines natural language processing, machine learning, and cognitive computing capabilities to analyze large amounts of unstructured data, understand human language, and generate insights to support decision-making.

It’s widely used in such industries as healthcare, retail, financial services, cybersecurity, and many more.

Key takeaways

- M&A software tools are those that are tailored to streamline the M&A process and make it more effective.

- M&A tools can be categorized into virtual data rooms, due diligence automation tools, financial modeling software, collaboration and project management tools, and AI analytics software.

- Virtual data rooms might be the most universal M&A tools, since they offer both a secure space for data sharing and collaboration tools for effective communication between the deal’s parties.