While global M&A practitioners anticipate a rebound in deal activity this year, let’s focus on the essentials that help to make deals work.

In this article, we’ll discuss the meaning of a term sheet in M&A transactions, its key components, benefits, and common pitfalls when drafting it. Additionally, you’ll get an M&A term sheet example to lean on when creating the one for your deal.

What is a term sheet in M&A?

A term sheet in M&A refers to the non-binding agreement between the target company and the prospective buyer that outlines the key terms and conditions of a potential transaction.

A term sheet provides a framework for the final agreement and helps to ensure that both parties have a sense of security and agreement on the crucial deal terms before investing significant time and resources into due diligence and final negotiations.

Note: Though being a non-binding document, a term sheet, however, prohibits parties from disclosing confidential information and secures its exclusivity.

The term sheet stage typically occurs at the beginning of the negotiation process and prior to due diligence.

Term sheet meaning vs. Letter Of Intent (LOI) meaning

On the surface, LOI and term sheet might seem similar as both are non-binding transaction documents that imply defining key deal terms and agreements. However, they are still different. Let’s briefly see how exactly they differ in the table below:

| Task | Letter of Intent | Term sheet |

|---|---|---|

| Level of detail | More detailed, often including legal terms and conditions | Less detailed, providing only key deal terms |

| Formality and structure | More formal, in the form of a structured letter with detailed sections | Less formal, often presented in bullet points |

| Negotiation stage | Later stage, typically after a term sheet is signed | Early stage, to ensure alignment on key terms before proceeding with LOI |

| Intent and commitment | Signal a more serious intent to move forward with due diligence and finalize the deal | Indicate initial agreement and willingness to negotiate |

Importance of M&A term sheets

Term sheet negotiations in M&A are essential for ensuring efficient due diligence and facilitating successful deal closure. Among the advantages of bringing term sheets to the M&A table are the following:

- Solid groundwork for M&A negotiations

Term sheets outline the key deal terms which gives both sides a clear starting point for negotiations. This way, an acquiring company and a target understand each other’s expectations and priorities early on, which, in turn, reduces the possibility of misunderstandings and sets a constructive tone for the discussions.

- Framework for due diligence

Clearly defining the main deal terms helps to focus on the important things during the due diligence process. Such a structured approach can also uncover potential issues early, allowing for informed decision-making. As a result, it can prevent surprises and delays later in the transaction.

- Clarity and alignment

The term sheet ensures that both sides are aware of their key zones of responsibility at the negotiation stage and are also on the same page in the process. Such an attitude fosters trust and cooperation between the buyer and seller and facilitates smoother progress toward finalizing the deal.

- Enhanced efficiency

With a term sheet in place, M&A process steps can proceed more straightforwardly. It helps streamline negotiations and decision-making by focusing discussions on agreed terms. This, in turn, can save both parties a lot of time and resources.

- Risk mitigation

By ensuring both parties are on the same page, term sheets can also help reduce potential risks and major deal-breakers early in the M&A process. When all the key deal terms are outlined, there’s less possibility of deal failure because of disagreements on essential issues or gaps in communication.

10 key components of M&A term sheets

Let’s now list term sheet essentials typically included in the agreement.

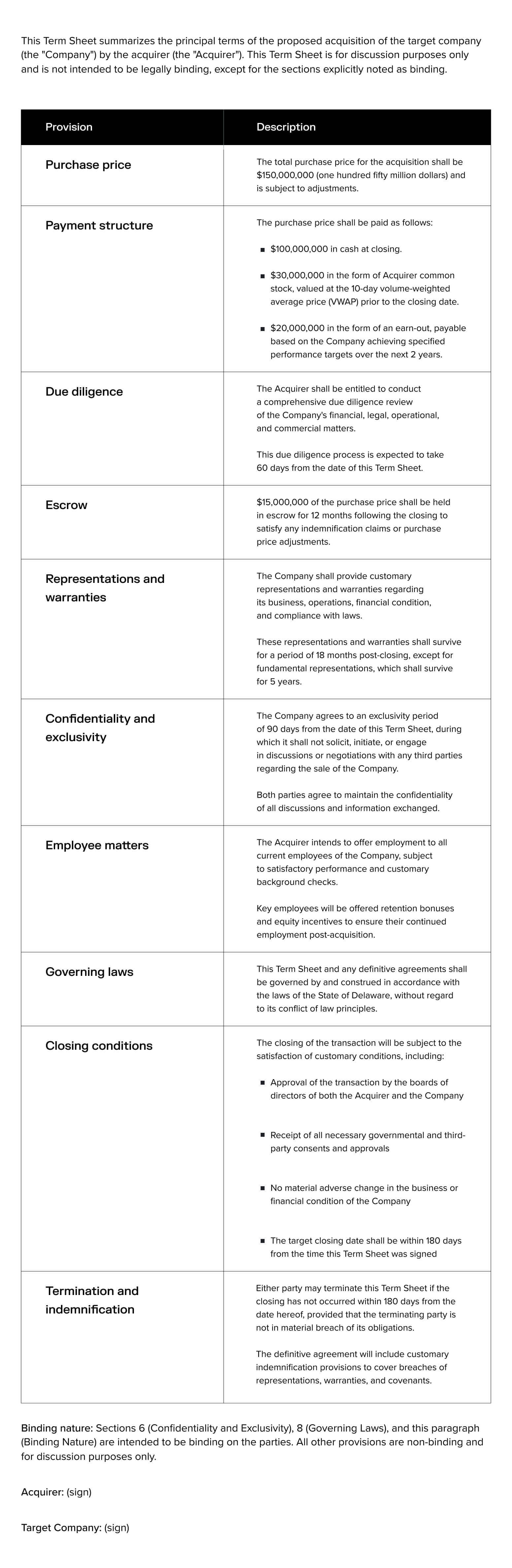

1. Purchase price

The first thing to include in a term sheet is a pre-agreed purchase price. This section specifies the initial deal price the sides agree on (which can still be changed based on due diligence findings).

Sometimes potential buyers also add a working capital peg. It means that by the time of deal closure, a seller must provide a buyer with an agreed-upon amount of working capital.

2. Payment structure

This section is about a structure of payment that will be used in the transaction.

This can be a stock purchase, all-cash transaction, stock-for-stock exchange, earn-out, etc. It can also be a combination of several payment structures, which is also clearly outlined in a term sheet.

Note: Learn what happens to your stock if a company is bought in our dedicated article.

3. Due diligence

The due diligence section typically outlines the key concepts of a due diligence process in a proposed transaction.

It might include the scope of the due diligence investigation, its terms and deadlines, and other details such as what key actions each side should perform to ensure a successful review.

4. Escrow

Sometimes a buyer may request a seller for an escrow that’s typically withheld from the purchase price. Escrow aims to safeguard the buyer from any misinterpretation, breach of confidential data and warranties, or undisclosed liabilities.

The amount of such a deposit depends on the deal size and type but typically estimates from eight to fifteen percent of a purchase price and is retained for about two years.

5. Representations and warranties

This is about basic assurances and guarantees that each party makes to the other.

By this section in a term sheet, both sides confirm that they are honest with each other and transparent about their operation and financial performance.

Some of the representations and warranties that are typically included in a term sheet are intellectual property, financial information, organizational data, litigation, environmental liabilities, and contracts and agreements.

6. Confidentiality and exclusivity

This is about provisions regarding the confidentiality of the discussions and whether there will be an exclusive negotiation period.

Confidentiality means that all sensitive data such as financial statements or legal documents are kept confidential by both parties.

The exclusivity provision means that a seller is restricted from entering into negotiations with other potential buyers and should keep the ordinary course of operations between the time the term sheet is signed and the defined end day of the exclusivity period (for instance, during 60 days).

This section of a term sheet also refers to definitive agreements and often has a binding nature.

7. Employee matters

Often, deal participants define in a term sheet how the key employees and employee benefits will be managed in the post-merger. This helps to reduce the risks of failure in the post-integration period, which is especially relevant considering that dealmakers attribute a large portion of M&A success to post-close integration.

Note: Learn about change management during mergers and acquisitions in our dedicated article.

8. Governing laws

The governing law provision specifies the jurisdiction under which the term sheet and the eventual definitive documents will be governed.

9. Closing conditions

As simple as it is, this section outlines under which conditions the deal will be considered closed.

It lists key milestones and deadlines and also defines the target date for closing mergers and acquisitions transactions.

10. Termination and indemnification

This provision details what party will be responsible for certain liabilities post-closing and under which conditions the deal can be terminated.

It also includes information about how indemnification claims will be managed.

Common pitfalls in drafting term sheets

Certain challenges may occur when drafting a term sheet. Let’s briefly review the main ones and see how they can be potentially solved.

- Lack of clarity

The nature of a term sheet calls for its clarity. Any ambiguities can lead to misunderstandings and disputes later. To avoid that, ensure all the key terms are clearly defined. Pay attention to the language used — there should be no phrases that can be interpreted in multiple ways. For best results, engage a legal counsel to assist with drafting a term sheet.

- Overlooking due diligence

Failing to outline the scope and timeline of due diligence can result in delays or incomplete investigations. To avoid that, specify the due diligence process in the term sheet, including the information required, the timeline, and who will bear the costs. This sets clear expectations for both parties.

- Inadequate confidentiality and exclusivity provisions

Without proper confidentiality and exclusivity clauses, sensitive data may be leaked, or a seller might engage with other potential buyers, undermining the deal. To mitigate such risks, ensure that confidentiality agreements and exclusivity periods in the term sheet are clearly defined and each party understands the liabilities coming with a violation.

- Failure to provide a detailed timeline

Without a clear timeline, the deal process can drag on, leading to frustration and potential deal fatigue. To avoid this, outline a detailed timeline for the completion of key milestones: due diligence, signing of the definitive agreement, and closing. Set realistic deadlines to keep the process on track.

Legal weight of term sheets

Generally, a term sheet is a non-binding document with minimal legal weight.

However, certain components of a term sheet are of a binding nature and have a bigger legal weight. These refer to such provisions as confidentiality, exclusivity, and governing laws.

If a term sheet includes an expenses clause that specifies what party is responsible for the expenses incurred during the negotiation process, it also has a legal power.

Merger and acquisition term sheet template

If you’re looking for an M&A term sheet example to draft the one for your deal, consider the example below. Please bear in mind that this is just an example of what can be included in a term sheet to use for inspiration. Consider the specifics of your case when creating the one for your deal.

Key takeaways

Let’s briefly summarize the main points from the article:

- A term sheet in M&A refers to the non-binding agreement between the seller and the buyer that outlines the key deal terms prior to proceeding with the due diligence.

- The main components of a term sheet include purchase price, payment structure, due diligence, escrow, representations and warranties, confidentiality and exclusivity, employee matters, governing laws, closing conditions, and termination and indemnification.

- Though a term sheet is generally a non-binding document, certain components of it are of a binding nature. These are confidentiality, exclusivity, and governing laws.