The dynamic nature of mergers and acquisitions inevitably impacts the levels of compensation for professionals who are involved in transactions. Besides, there are lots of other factors that influence M&A specialists’ pay ranges.

In this article, we figure out aspects that form the merger and acquisitions salary, explore its different levels based on the position and location, and provide information on how global M&A activity in the coming year can impact compensation levels for M&A professionals.

Factors affecting mergers and acquisitions salaries

A merger and acquisition salary can differ greatly, depending on many factors. Let’s review the main of them below.

Line of business

The compensation range for M&A professionals can vary greatly based on the line of business they work with.

As simple as that, M&A professionals who are involved in high-profit lines of business are more likely to get a higher base salary and better bonuses than those who work with low- or medium-profit lines.

However, it’s not always the case. The M&A salary can also depend on the priority the certain line of business has at a time in overall business operations.

Specialization

Naturally, the level of M&A compensation greatly depends on the specialization of an M&A professional and the seniority of a position they assume. For instance, the salary of an M&A analyst is likely to be lower, since this is an M&A specialization of entry levels. While M&A directors are most likely to get a higher compensation since this job presupposes having more experience.

Additionally, the track record of successfully managed and completed deals counts as well.

Note: Learn more about M&A management best practices in our dedicated article.

Compensation agreements

This relates to the agreements of the bonus vs. salary ratios an M&A professional makes with an employer.

M&A salary typically consists of base pay (a fixed sum paid monthly) and bonus pay, that’s why their ratio is a discussion point during the hiring process. For example, a company, investment bank, or advisory firm can offer a particular M&A professional a rich bonus package and the base pay in this case might be relatively low.

On the other hand, a higher base pay might exclude the possibility of getting a rich bonus package.

Company of employment

The salary of an M&A professional also differs depending on their company of employment: corporation or investment bank.

Normally, an average M&A manager salary is considered to be higher in an investment bank, while M&A professionals working in corporate finance get a bit less.

Deal nature

Depending on the complexity or the scale of the deal, the mergers and acquisitions manager salary will vary.

For example, M&A professionals who advise on such large deals as the Activision Blizzard and Microsoft merger ($69 billion deal value) can get a higher M&A advisor salary than those who manage smaller deals worth millions of dollars.

Market conditions

Though not obvious from the start, the current state of the M&A market and economic conditions in general can significantly impact the salary range of M&A specialists.

Naturally, when the market is flourishing, there’s a higher demand for M&A professionals such as M&A managers, associates, or analysts. As a result, such a demand boosts the rate of compensation in M&A sector. For instance, such a rapid M&A market as it was in 2021 is more likely to offer higher salary levels for M&A specialists.

Note: To understand the industry and its peculiarities better, read more about mergers and acquisitions definition in our dedicated article.

Bonus and incentive structures in the M&A job market

The compensation of an M&A professional typically consists of base pay plus bonuses. While it’s all clear with the base pay, bonuses can be different:

- Annual bonus

M&A managers often receive an annual bonus based on their performance and the success of the business deals they work on. Such a bonus is often directly tied to specific target objectives or plans an M&A specialist should achieve. Usually, such bonuses are also significant add-ons to the base pay.

- Profit sharing

Sometimes, M&A managers may participate in profit-sharing programs when working on the deal. It means that they can get a share of the company’s profits related to M&A activities and business acquisition financing. Further, it also aligns their interest with the company’s financial success.

- Stock options

As a part of compensation, companies sometimes can also offer M&A specialists stock options or equity grants. This gives an M&A manager a stake in the company’s performance and future growth.

- Signing bonus

Sometimes, companies may offer a one-time payment in the form of a signing bonus to attract new and experienced M&A specialists, when they’re joining an organization.

- Retirement benefit

As a part of a compensation package, M&A managers can also receive contributions to their retirement plans, such as a 401(k) plan.

- Health and insurance benefit

Some companies can also provide M&A specialists with health insurance coverage as a part of the compensation package. Sometimes, such a benefit also includes dental and vision plans.

Role-specific M&A job salary analysis

Let’s now take a closer look at how exactly an M&A professional like an analyst, associate, manager, or director can make per year on average, based on the Glassdoor statistics.

As seen from the comparison table, there are different levels of compensation for different jobs in the M&A labor market. However, M&A directors normally get about 61% higher compensation than M&A analysts.

Average acquisitions’ manager salary by location

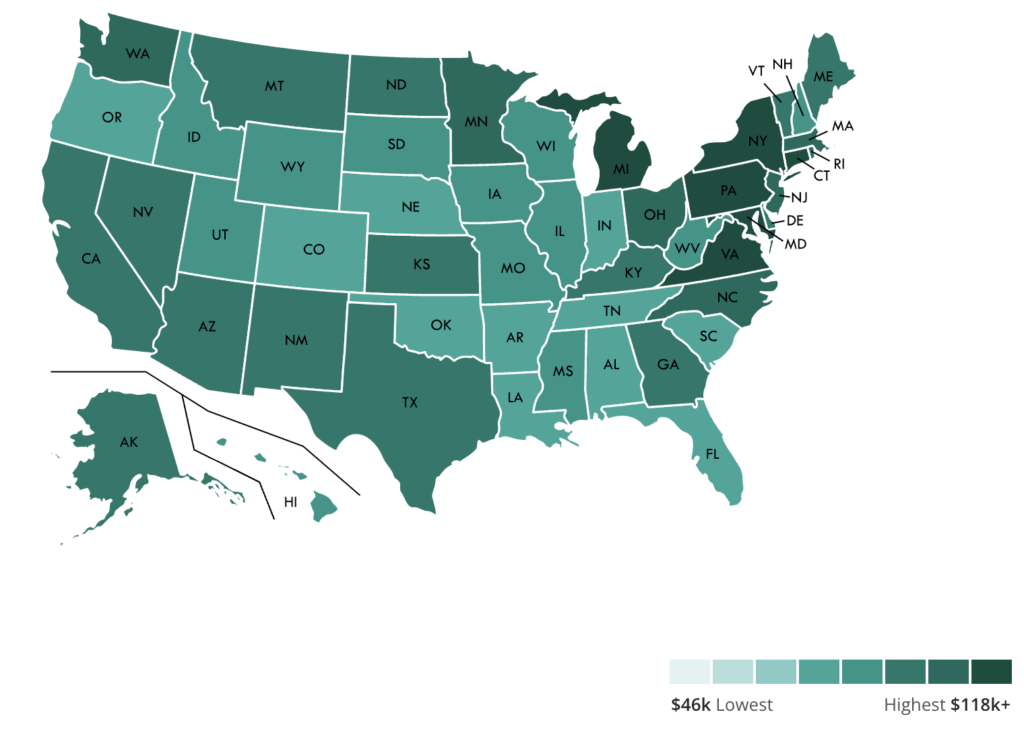

Often, the location of your M&A job also matters. Inside the United States alone, some states are known for higher M&A professional income statistics, while others usually pay less.

Let’s take a closer look at the comparative data on how average M&A salaries of similar job titles differ in terms of site connection depending on the city or state.

This is how the distribution of annual M&A manager salaries looks like in different US states.

The most high-paying US states include:

- Connecticut ($118,478)

- District of Columbia ($116,830)

- Maryland ($115,236)

- Virginia ($115,154)

- Pennsylvania ($110,890)

The lowest-paying US states include:

- Colorado ($75,295)

- Oklahoma ($75,508)

- Alabama ($76,371)

- South Carolina ($77,217)

- Tennessee ($78,580)

The future outlook for M&A salary

As pointed out above, M&A salary growth or decrease significantly depends on many factors, and the state of the current M&A market is one of them.

Let’s analyze M&A compensation trends based on the general industry trends and insights:

- Overall M&A activity

The global M&A activity has been in relative lethargy during recent years, with 2023 showing a 6% and 25% decline in M&A volumes and values compared to the prior year. However, despite that, M&A experts feel more positive about the coming year, anticipating the M&A market to start rebounding. This will more likely positively impact the M&A specialists’ salaries as well.

- Leading sectors

PwC’s report states that M&A activity is starting to recover mostly in the technology, energy, and pharma industries, while other sectors, such as banking and healthcare, remain slower. Such an activity can also speak about the rising demand for M&A professionals in recovering industries, which, in turn, can also positively impact their compensation rates.

- Geopolitical turmoils

Ongoing conflicts in the Middle East, Russia-unleashed war in Ukraine, and export controls on China keep having a heavy impact on global deal-making. This also puts M&A activity in/with those regions under threat, which, in turn, can negatively impact levels of M&A specialists’ compensation there.

- Cybersecurity concerns

Security of data remains the major priority for deal-makers, with more deals occurring in the IT sectors. M&A practitioners are also in need of specialists who can ensure a secure proceeding of all M&A process steps. This creates an M&A opportunity for managers with cybersecurity expertise, and, as a result, they might be among higher-paid professionals in the coming year.

Key takeaways

- Merger and acquisition salary greatly depends on such factors as education, experience, location, company size and industry, deal nature, and overall market conditions.

- M&A salary usually consists of a base pay and bonus pay. Bonus pay can include such benefits as an annual bonus, profit sharing, stock options, signing bonus, retirement benefit, and health insurance benefits.

- The average pay range of M&A salary can be from $151,000 to $423,000 per year depending on the position.

- The most high-paying US states in terms of M&A salary are Connecticut, the District of Columbia, and Maryland. The lowest-paying are Colorado, Oklahoma, and Alabama.