Though dealmakers admit certain lethargy of the global M&A activity in most sectors recently, 2023 brought some hope, with mergers and acquisitions in the middle market showing some positive movements. Thus, 55% of dealmakers expect more middle-market deal activity in 2024, according to ACG’s survey.

In this article we explore the current M&A middle market, outline its potential challenges, and try to predict its performance in 2024.

The rise of middle market M&A

Before delving into trends in mid-market mergers and acquisitions, let’s first recap what kind of M&A deals sit in the middle market.

So what are the key trends of the current M&A market, and how do middle market transactions take the lead? This is what PwC’s M&A 2023 report states about this:

- Compared to record-breaking M&A activity in 2021 and those of pre-pandemic levels, global deal values dropped 50% to $2.5 trillion in 2023. Deal volumes also declined by 17% from about 65,000 deals in 2021 to nearly 55,000 deals in 2023.

- The number of megadeals fell by almost 60% — from 150 transactions in 2021 to less than 60 deals in 2023.

- At the same time, mid-market transactions stood up and showed certain improvements. This is because such finance deals are easier to conduct during a global financial crisis and geopolitical tensions, and dealmakers now follow a strategy of making a series of small deals when seeking transformation and growth.

Malcolm Lloyd, Global Deals Leader and Partner from PwC Spain, believes that global deal-making shows signs of rebounding and has promising potential in 2024:

Market signals are more positive, and we’re seeing a willingness among dealmakers to find creative solutions to get deals done and accelerate transformation. I believe these factors — and pent-up demand — have created a tipping point, and we will see an upswing in M&A in 2024.

2024 opportunities in mid-market M&A

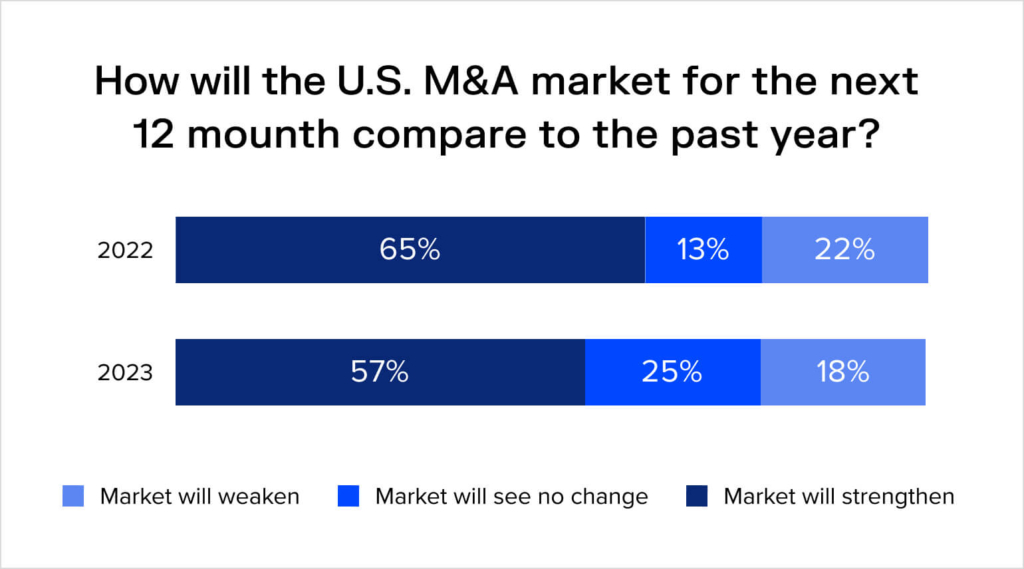

According to Dykema’s M&A Outlook Survey, 57% of respondents expect the M&A market to strengthen in 2024.

At the same time, most respondents predict a deal volume increase in middle and lower markets in particular: 43% of surveyed dealmakers expect a rise in middle market deals and 52% believe a boost will take place in lower markets.

So, let’s now discuss the main signs of the middle market’s potential to keep rising in 2024 and the key trends in this process.

Hopes for potential M&A activity improvement

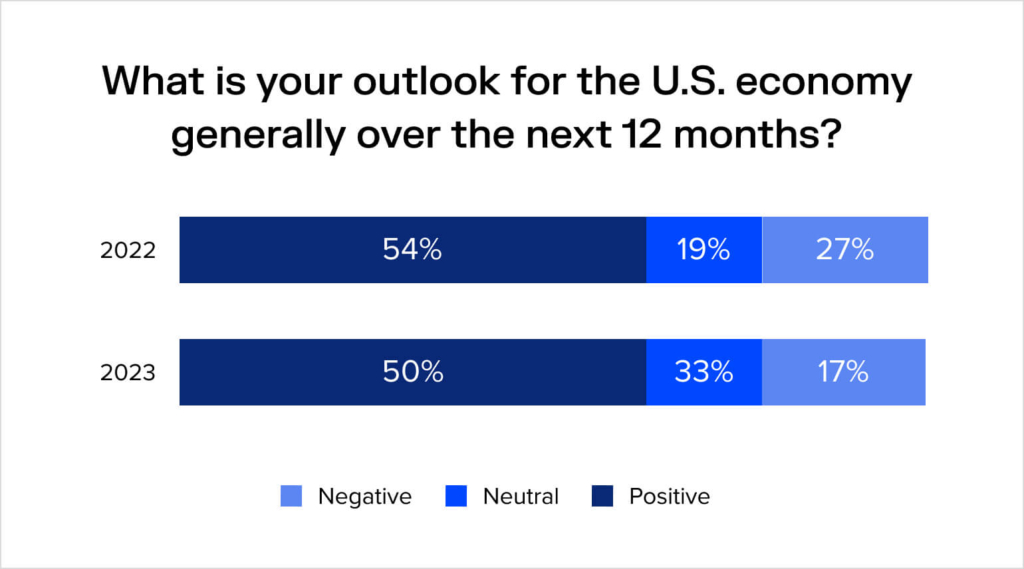

M&A practitioners have largely positive expectations for the economy in 2024. The above-mentioned Dykema survey indicates that 50% of surveyed dealmakers have a positive outlook for the US economy over the next 12 months, while only 17% have negative expectations.

Positive anticipation is also seen from the PwC’s 27th Annual Global CEO Survey, where 60% of CEOs state they plan to make at least one acquisition in the next three years.

3 sectors are likely to take the lead

When it comes to business sectors, M&A practitioners and business leaders expect the most middle-market investments to be seen in the energy, financial services, and healthcare areas.

At the same time, PwC specialists predict that M&A recovery in financial and healthcare services might not be as rapid as in the energy sector.

Interest from private equity firms continues

During recent years, the quantity of dry powder was increasing while investors remained selective. In 2023, dry powder reserves in the private equity industry hit $4 trillion.

Such a large amount of dry powder speaks volumes about the high possibility of private equity firm investors stepping into the market and putting this money to work. Considering global trends and overall cautiousness, the investment choice might fall on the lower middle market and middle market companies, as they’re more agile and can adapt to tense economic circumstances, and thus, present less risk to investors.

Note: Read more about different types of business acquisition financing in our dedicated article.

Challenges in navigating middle market M&A

While mid-market M&A transactions are likely to rebound in the next 12 months, such deals also face certain challenges that may significantly impact deal value, cost savings, and overall outcomes.

Let’s briefly review the three main challenges for middle-market M&A deals.

Lack of experience

90% of middle-market companies that were sold or merged and 70% of middle-market companies that made an acquisition in the last three years had little or no previous M&A experience. This leaves them more reliant on advisors and makes it more difficult to avoid mistakes and ensure a smooth transition.

Quick tips:

- Create a thorough middle market acquisition strategy, paying special attention to outlining deal targets and expected outcomes.

- Engage experts, such as M&A advisors, investment bankers, or consultants who can provide valuable insights, guidance, and support throughout the entire M&A process.

Incorrect assessment

41% of buyers and 43% of sellers from the middle market companies admit they find it very difficult to perform a correct valuation of the business they’re buying or selling. This can also relate to the lack of experience in M&A activities.

Quick tips:

- Conduct comprehensive due diligence covering all aspects of the business, including financial, operational, legal, and cultural factors.

- Engage experienced professionals and specialized teams to perform due diligence, ensuring that all potential risks and opportunities are identified and properly evaluated before proceeding with the transaction.

Integration challenges

Another significant challenge mid-market M&A practitioners may face is complications during the integration process.

According to research, 44% of buyers and 44% of sellers believe that post-merger integration (both technical and cultural) is a major challenge during the M&A process.

Quick tips:

- Develop a detailed integration plan that outlines specific goals, timelines, responsibilities, and milestones for each aspect of the integration process.

- Involve key stakeholders from both companies early in the integration planning process to ensure alignment and buy-in.

- Ensure transparent and regular communication to address concerns, manage expectations, and foster a collaborative and cohesive organizational culture.

Note: Explore the major types of general mergers and acquisitions risk in our dedicated article.

Best practices for successful middle-market deals

To ensure successful middle-market M&A activity in 2024, dealmakers should consider the following recommendations:

- Prioritize strategy

Having a thorough M&A strategy is as important as having a business model for a business to work. According to the Deloitte 2024 M&A Trends Survey, 44% of corporate executives name M&A strategy as the key aspect in achieving deal success. Read more about mergers and acquisitions strategy in our dedicated article.

- Mind the digitalization impact

There’s a high chance that in 2024 dealmakers will target companies that successfully implement AI capabilities in their operations. As a result, middle-market businesses need to prioritize digitalization and find ways to integrate AI into their services to stay attractive to potential investors.

- Engage third-party experts

Considering the fact that middle-market dealmakers typically lack expertise in M&A activities, having experienced professionals involved in the deal process might increase its chances of success.

Key takeaways

- Despite the overall lethargy of global M&A activity, M&A practitioners see signs of a rebound in the middle-market M&A sector.

- Large volumes of dry powder reserves predicted reductions in interest rates, and an overall need for businesses to adapt to global financial crises and geopolitical tensions could provide growth opportunities for M&A activity in 2024.

- M&A experts predict positive improvements in the middle market since such deals are easier to conduct and dealmakers now follow a strategy of making a series of small deals when seeking transformation and growth.