Despite the global M&A slowdown that began in 2022, the market has seen enough large M&A deals that could shape the sector and even bring hope for activity rebound.

In this article, we’ll take a look at the 2023 M&A market and the top 10 recent deals in M&A. Additionally, we’ll review the main M&A projections for 2024. Read on to explore.

The scope of recent M&A activity

Before exploring the selection of the top 10 latest mergers and acquisitions of 2023, let’s first look at global 2023 M&A activity insights.

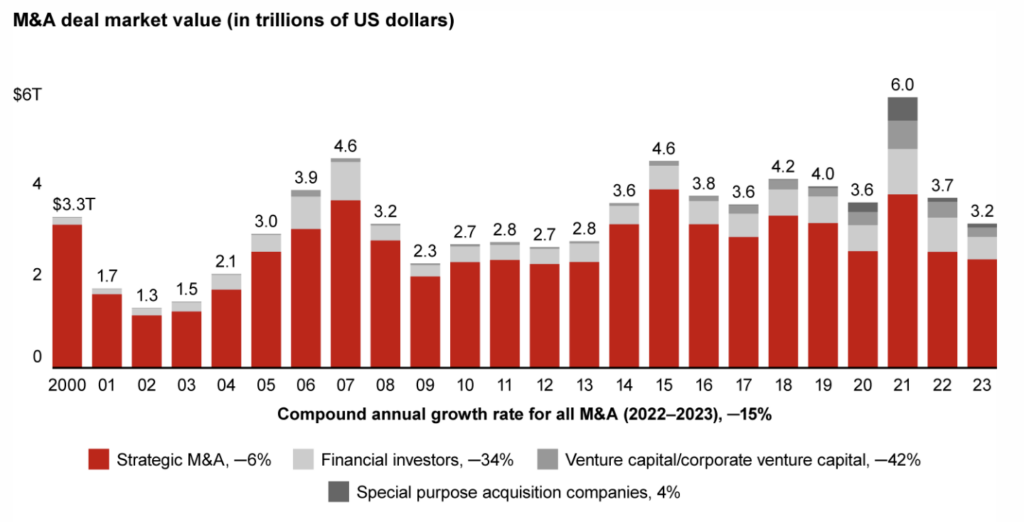

In 2023, global M&A activity dropped 15% to $3.2 trillion year-on-year, which is the lowest level since 2013.

The reasons for such low volumes are high interest rates, regulatory scrutiny, mixed macroeconomic signals, and geopolitical turmoil.

However, the tech industry remained the top choice of dealmakers, constituting 27% of global deal value and even showing a 1.1% growth in deal volume.

This is how Morrison & Foerster describes the 2023 M&A activity in regions:

- North America

M&A deals in this sector totaled $1.46 trillion, which is a 12% decrease from 2022. The second half of the year showed some promising activity, including megadeals such as Cisco and Splunk, and Exxon and Pioneer. - Asia Pacific

The Asia-Pacific region showed a 26% YoY decline, totaling $708.2 billion in deal value. The healthcare industry was the leading sector in this region, and Japan was a bright spot, with a 34% growth YoY in the number of deals. Notably, due to politics, cross-border activity between China and America continued to stall. - Europe

The EMEA region showed a 35% YoY decline, constituting $676 billion in deal value. The US companies predominantly led inbound acquisitions.

Explore the complete list of companies that have merged in the last 5 years in our dedicated article.

10 recent M&A deals of 2023

Now, let’s review the most prominent recent M&A transactions conducted in 2023.

1. ExxonMobil and Pioneer

Deal value: $60 billion

Industry: Energy

ExxonMobil announced its acquisition of Pioneer in October 2023 for $60 billion. The Wall Street Journal called it the largest oil-and-gas acquisition in two decades.

Both companies are industry giants, and their merger allows for the creation of “a diversified energy company with the largest footprint of high-return wells in the Permian Basin,” according to Pioneer’s ex-CEO Scott Sheffield.

Industry experts project ExxonMobil’s production volumes in the Permian Basin to reach 2 million barrels of oil equivalent per day by 2027 compared to 1.3 million in 2023.

The deal was completed in May 2024.

2. Chevron Corporation and Hess Corporation

Deal value: $53 billion

Industry: Energy

Chevron Corporation announced its acquisition of Hess Corporation in October 2023, just a little more than a week after the ExxonMobil and Pioneer merger announcement. This is the second-biggest deal among recent M&A transactions of 2023.

By combining their resources, Hess and Chevron expect to grow production and free cash flow faster and for longer than Chevron’s current five-year guidance. With this acquisition, Chevron also aims to diversify and elevate its already impressive portfolio.

3. Seagen and Pfizer

Deal value: $43 billion

Industry: Pharmaceuticals

Pfizer announced its plans to acquire Seagen in March 2023. These are Pfizer’s investments to battle cancer since Seagen is a leader in Antibody-Drug Conjugate (ADC) technology. Together, the companies plan to change the cancer treatment paradigm.

We believe Oncology will be a significant growth driver for Pfizer and contribute meaningfully to the achievement of our near- and long-term financial goals.

Dr. Albert Bourla

Pfizer Chairman and CEO

4. Cisco and Splunk

Deal value: $28 billion

Industry: Technology

Cisco’s acquisition of Splunk was announced in September 2023.

Networking giant Cisco acquired Splunk, a security and observability platform developer, to drive the next generation of AI-enabled security and observability.

We’re excited to bring Cisco and Splunk together. From threat detection and response to threat prediction and prevention, we will help make organizations of all sizes more secure and resilient.

Chuck Robbins

Chair and CEO of Cisco

Industry experts also predict the deal to be highly beneficial for Cisco, allowing for essential staff reductions.

The transaction was completed in March 2024.

5. KKR and Telecom Italia (TIM)

Deal value: $23.5 billion

Industry: Telecom and media

KKR, a leading global investment firm, is set to acquire TIM’s fixed-line network assets for up to €22 billion (about $23.5 billion), which includes the assumption of debt and potential earn-outs under certain conditions. This structure provides TIM with immediate liquidity to help reduce its substantial debt and focus on its core service operations.

The deal is about to be finalized in the summer of 2024.

6. Physicians Realty Trust and Healthpeak Properties

Deal value: $21 billion

Industry: Healthcare and real estate

The deal between Physicians Realty Trust and Healthpeak Properties is one of the largest recent company mergers in the healthcare and real estate industries. It was announced in October 2023.

Both companies are major players in the sector, owning different healthcare properties — from medical office buildings to continuing care retirement communities. Healthpeak sees this deal as a strategic move to expand its portfolio and get access to broader markets.

The merger was closed in March 2024 and the combined company will operate under “Healthpeak Properties, Inc”.

7. Newmont and Newcrest Mining

Deal value: $19.1 billion

Industry: Mining

A merger between Newmont and Newcrest Mining is one of the most recent M&A deals. It was announced in May and closed in November 2023.

By entering into this definitive agreement, Newmont Corporation aimed to benefit from Newcrest’s assets and expertise in the gold mining industry, and thus grow its global influence and operational efficiencies.

The combined company is projected to become the world’s leading gold miner.

8. ONEOK and Magellan Midstream Partners

Deal value: $18.8 billion

Industry: Energy

ONEOK, a midstream oil and gas company, announced its intentions to acquire Magellan Midstream Partners in May 2023.

The combination of ONEOK and Magellan will create a diversified North American midstream infrastructure company with predominantly fee-based earnings, a strong balance sheet, and significant financial flexibility focused on the delivery of essential energy products.

Pierce Norton

CEO of ONEOK

Dealmakers expect this marriage to create one of the largest US energy pipeline companies.

The deal was completed in September 2023.

9. Japan Industrial Partners and Toshiba

Deal value: $15 billion

Industry: Electronics

Another example of recent company acquisitions is Toshiba’s intention to sell itself to Japan Industrial Partners (JIP). This deal was announced in March 2023.

Toshiba has been through several negative events — from the 2011 tsunami to the 2015 accounting scandal. With this deal, Toshiba is to become private, which is expected to bring stability to the company.

This move for Toshiba is great not only for Japan but also for the world. I have faith in the revival of Toshiba.

Toshiba’s Chairperson Akihiro Watanabe

10. Silicon Valley Bank and First Citizens Bank

Deal value: $16.5 billion

Industry: Finance

First Citizens Bank announced its acquisition of Silicon Valley Bank’s assets and liabilities in March 2023, right at the time when Silicon Valley Bank (SVB) was melting.

Recent transaction details claim that with this acquisition, First Citizens Bank hopes to get access to SVB’s startup and venture capital community, enhancing its digital banking capabilities and influence.

This transaction leverages our solid foundation to add significant scale, geographic diversity, compelling digital capabilities, and most importantly, meaningful solutions for customers throughout their lifecycle.

Frank Holding, Jr.

Chairman and CEO of First Citizens

2024 M&A trends projections

Knowing the list of recently announced and completed deals of 2023, let’s now take a brief look at the current M&A deals activity and current trends in the market.

This is what the latest headlines talk about in 2024:

- Relative M&A surge

Dealmakers expect global M&A activity to see a certain rebound starting from 2024 and 60% of CEOs plan to make at least one acquisition in the next three years. - Mid-market deals in focus

Industry experts believe that the rise of M&A activity will first occur in small- and mid-market mergers and acquisitions. Dykema’s M&A survey shows that 43% of dealmakers predict an increase in mid-market M&A activity, while 53% anticipate a rise in the small market. - Need for transformation

PwC’s survey shows that business leaders are in search of quicker ways to create value and keep their businesses in competition through the M&A process. According to their findings, 45% of CEOs doubt their company’s current trajectory will keep them competitive and viable beyond the next decade. - Rebound of private equity deals

EY’s Deal Barometer indicates that PE deal volumes are likely to grow 16% in 2024. This is relevant considering about $4 trillion of global dry powder is currently in the reserves.

Key takeaways

- Global M&A activity dropped 15% to $3.2 trillion YoY, which is the lowest level since 2013.

- However, there were a number of large deals that shaped the market. Some of the recently acquired companies include Seagen, Splunk, Newcrest Mining, and Toshiba.

- Dealmakers expect a relative rebound of M&A activity in 2024, with mid-market acquisitions being in favor.