In the business world, the debate rages on: Do mergers and acquisitions truly drive shareholder value?

As M&A appears to be regaining its footing, some leaders might be tempted to stay on the sidelines. Yet, history has shown that those who embrace the game with skill and precision are the ones who emerge as winners.

While academics and professionals often debate the value of M&A deals, many companies see value in M&A, as evidenced by more than 90% of S&P 500 companies having engaged in public or private acquisitions in the last decade, according to an EY analysis.

When organic growth falls short or moves too slowly, acquisitions step in to propel companies forward, optimizing costs, refining capital structures, and acquiring invaluable intellectual property and capabilities.

Breaking down the numbers: a tale of two approaches

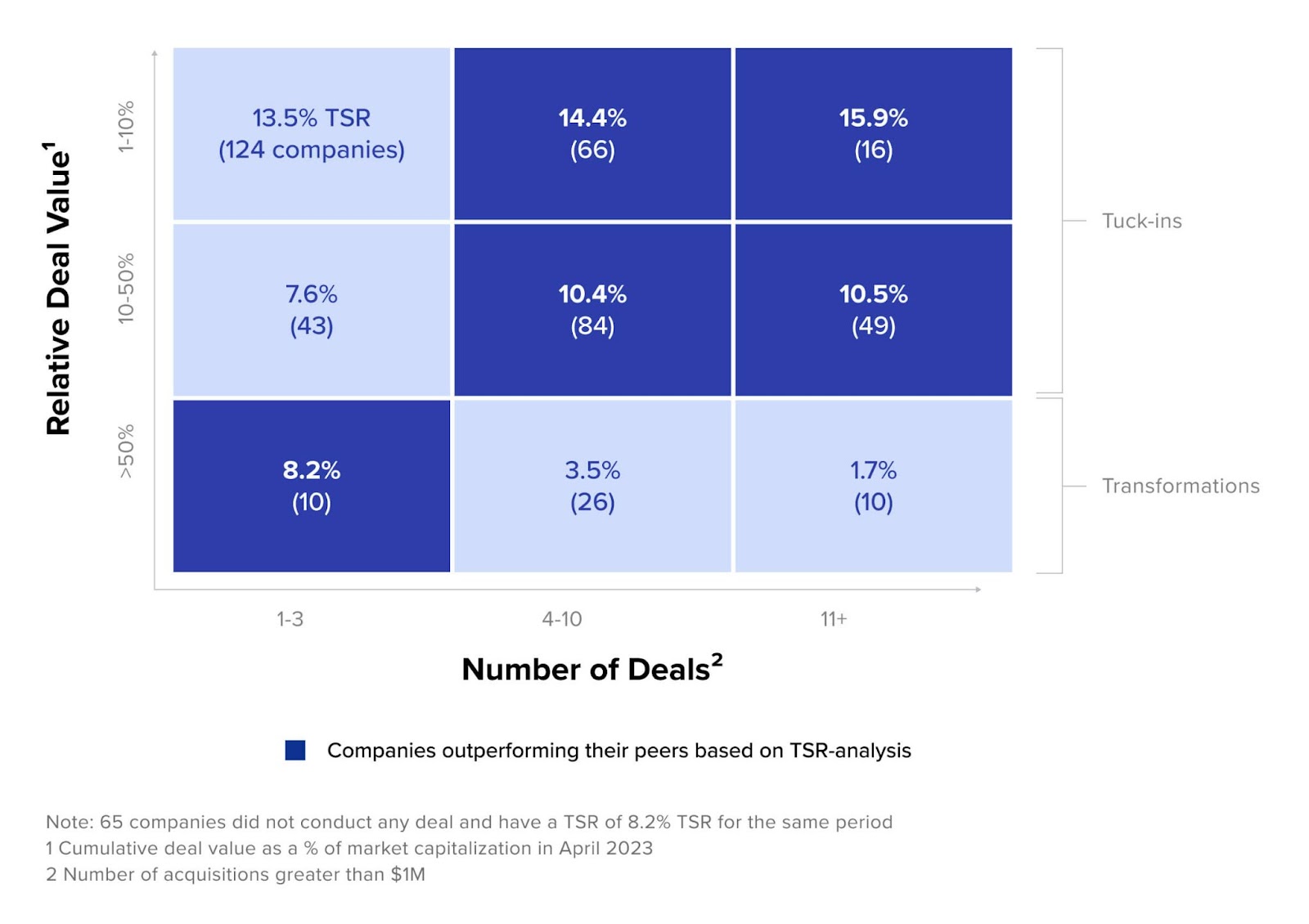

Our analysis unveils intriguing insights:

- Companies undertaking smaller acquisitions tend to thrive, with an uptick in total shareholder return (TSR) as they increase deal volume.

- Conversely, those embarking on larger-scale acquisitions find higher TSR when they opt for a more selective approach.

Building on prior EY research, we delved into the data of S&P 500 companies engaging in buy-side transactions valued at more than $1 million between April 2014 and April 2023. The results were striking.

A closer look: tuck-in vs. transformation

- For companies focusing on tuck-in or bolt-on acquisitions or smaller-sized transactions, the formula for success is clear: more deals, more TSR. These savvy players enjoy an annualized TSR outperformance of 2%-5% over their counterparts.

- On the flip side, companies venturing into transformational acquisitions or deals adding up to more than 50% of a company’s market capitalization tread a different path. Here, fewer deals lead to an annualized TSR outperformance of 4%-6% as opposed to companies doing more large deals, signaling a focus on quality over quantity.

In a landscape where S&P’s average returns hover around 9.2%, these margins are nothing short of game-changing for both investors and stakeholders.

Average annualized total shareholder return (TSR) for S&P 500 companies

Unraveling the success stories

In the realm of tuck-in acquisitions, champions emerge. Fortune 500 giants, executing over 11 acquisitions for less than 10% of their market capitalization, saw a staggering 15.9% year-over-year TSR growth.

Meanwhile, the cohort completing 4–10 acquisitions achieved an impressive 14.4% year-over-year TSR. Among these, a payment card services powerhouse stands out, having orchestrated eight tuck-in acquisitions. This strategic move not only expanded their service offerings, but it also catapulted them to a +7% year-over-year TSR lead over non-acquiring S&P 500 counterparts.

Regarding transformative deals, based on data, we see that 10 Fortune 500 companies did between one and three transactions with a deal value of more than 50% of their market capitalization.

This group gained 8.2% year-over year TSR, which is significantly higher than companies that did more mega deals or deals representing greater than 50% of their market capitalization. One of those companies, a health care insurance provider, generated a return of 14%. It closed three public acquisitions during that time, including two small deals and one that was transformational.

This is a prime example of a company being strategic when executing a transformational deal and thoughtfully considering the time and resources necessary for a successful integration.

The engine of success: key factors at play

The secret sauce?

- Seasoned corporate development teams

- Fortified M&A infrastructure

- Agile leadership capable of navigating risks swiftly.

It’s this blend of experience, muscle memory, and adaptability that allows these companies to integrate seamlessly while maximizing deal value.

Navigating the future: recommendations

For those in the tuck-in and bolt-on acquisition arena, success is built on a few fundamental principles:

- Foster a robust M&A “muscle memory” for streamlined integration and synergy maximization.

- Stay proactive in the M&A market, seizing opportunities and keeping a watchful eye on competitors.

- Recognize that integration is an investment; institutionalize, learn, and refine for long-term success.

In the realm of transformative acquisitions, a focused approach is the linchpin to success. Embrace these recommendations:

- Dedicate top-tier talent to the integration process for maximum value realization.

- Engage in transparent, frequent communication to foster a sense of pride and achievement among all stakeholders.

- Allow ample time for businesses to adapt, evolve, and flourish post-acquisition before embarking on the next endeavor.

The key to shareholder returns lies not in a one-size-fits-all approach but in the astute deployment of strategy and execution. With the right moves, M&A can be a powerful catalyst for not only growth but also for delivering sustained shareholder value.

Co-authored by Lukas Hoebarth, Markus Neier, Mitch Polelle, and Adam Altepeter.

The views reflected in this article are those of the authors and do not necessarily reflect those of Ernst & Young LLP or other members of the global EY organization.