In the past two years, dealmakers faced numerous challenges. COVID-19 vaccines release, Omicron wave, supply chain disruptions, geopolitical conflicts, and the onset of inflation, just to name a few.

Defying these complications, the M&A market and dealmakers proved their resiliency, with deal activity rapidly becoming a protagonist of value generation and economic growth.

This article provides the M&A dealmaking statistics and predictions for the rest of 2022, outlining the main M&A 2022 trends.

2022 M&A trends: General overview

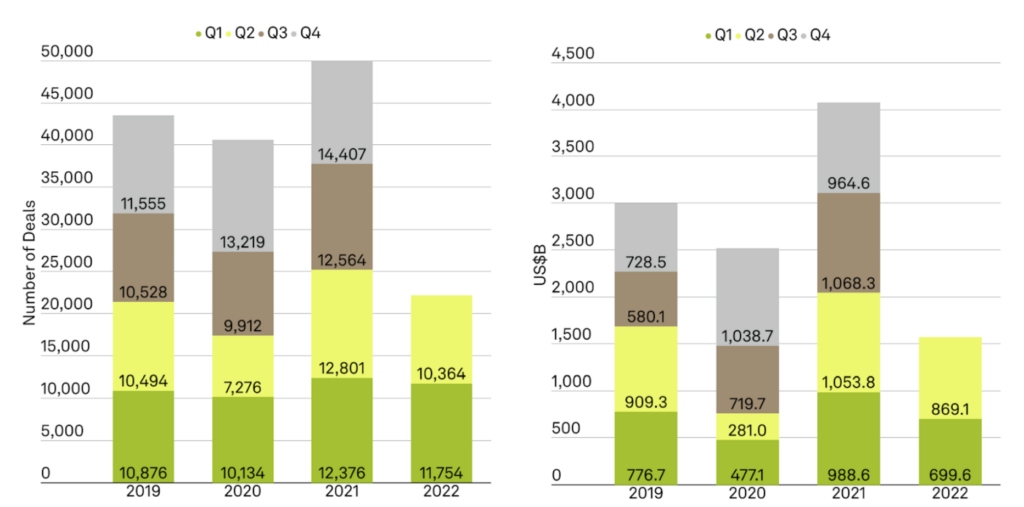

The first half of 2022 was marked by a substantial slowdown in deal activity and M&A synergies: the total deal value has dropped to nearly $1,569 billion, which is almost 23% lower than in H1 2021. The number of global deals announced in the first half of 2022 has also experienced a 12% drop compared to H1 2021: 22,118 global deals in total.

Source: S&P Global

This was mainly caused by geopolitical tension, which is reflected in the volume of cross-border deals. The cross-border activity in H1 2022 has decreased: by 24% 2022 compared to 2015-2019.

On the contrary, the cross-border deal activity between closely affiliated countries has increased: by 51% in 2022 compared to 42% over 2015-2019. For example, the total value of investments from China into the U.S. has declined from $27 billion in H1 2016 to the announced value of $1.9 billion in 2022. By contrast, North American investment in Europe has increased from $60 billion to $149 billion over the same period.

Note: To learn more about merger and acquisition examples that took place in 2022, read our dedicated article.

Main all-market segments insights of Q3 2022

Throughout H2 2022, all types of mergers and acquisitions continued to be deeply affected by the many uncertainties hindering the market. Q3 2022 saw a 55% dip in global M&A volume YOY, with the aggregate value of Q3 acquisitions falling below $1trn for the first time in eight consecutive quarters.

The third quarter of 2022 is also marked by:

- Underperformance of the regional index by European acquirers — by -6.7 percentage points — which has obviously resulted from the geopolitical tension in that region.

- Outperformance of the regional index by Asia Pacific and North American acquirers: by +14.4 percentage points and +4.5 percentage points, respectively.

The degree to which Q3 2022 deal activity is down resulted in the lowest total deal volume among all other Q3s since 2017, and the slowest overall quarter since the pandemic-ravaged Q2 2020, according to Refinitiv.

Source: Bloomberg Law

- The total volume of Q3 mega deals counts $50 billion, which is 72% lower than the average of $179 billion per quarter.

- Overall volume of large deals amounts to $242 billion, which is 23% lower than the average volume per quarter of $314 billion.

- Total volume of middle market deals was $166 billion in Q3, which is 18% lower than the average of $202 billion per quarter.

- Q3 small deals’ total volume amounts $46 billion, which is 13% lower than the average quarterly volume of $53 billion.

Private equity deals

Private equity transactions made around 27% of global M&A transactions in 2021. Based on funds that were raised recently, the amount of dry powder, and newly available funds, business leaders consider that private markets will continue to be in demand in 2022.

Private equity now already makes up more than half of world mergers and acquisitions.

According to Morrison Foerster, the remainings of 2022 aren’t likely to show any slowdown. The private equity firms must be ready for the increased competition.

Regulatory scrutiny

Antitrust enforcement was one of the critical issues of 2021 and intensified throughout 2022. Many entities around the globe, including the U.S. Department of Justice and the Federal Trade Commission, increased the scrutiny of deals under the antitrust laws. This tendency did not change during the Joe Biden presidency because of his government’s focus on it, so companies continued to prepare for more aggressive regulations.

Bracing for tighter liquidity

Investors in North America, which accounts for 40 percent of all cross-border deals so far in 2022, are looking forward to getting the Federal Reserve’s response to inflation. Many business leaders see hikes in the discount rate, making acquirers rely on debt financing to close deals faster. With rising interest rates in 2016-2019, deal value and volume rose. Expectedly, Q4 2022 promises to bring similar perspectives.

Divestitures and spinoffs as a path to strategic focus

Based on the global growth environment and favorable capital markets, many companies chose separation and asset divestitures in 2021. This was mainly done to bring more strategic clarity to core businesses, and this tendency is expected to continue throughout the last months of 2022.

Digital transformation

For the last decade, digital transformation has been a top priority for business leaders in all parts of the world, from the U.S. to the Middle East. The COVID-19 pandemic has only increased the speed of deal market digitalization, so making it an integral part of corporate strategy is likely to continue.

Environmental, social, and governance (ESG) goals in focus

Private equity firms, member firms, and all types of corporations are now considering their ecological footprints. Most modern companies consider rationalizing, purchasing, or divesting assets. Investors will continue to regard the ESG agenda as critical to building a sustainable business.

The Russian invasion of Ukraine’s influence

The influence of the war in Ukraine on the global economy and M&A deals is immense. With buyers and sellers focused on understanding the impact of the Ukraine-related sanctions. If the war doesn’t end by the end of the year, it will result in a continuous slowdown in global transaction volume. Such historical events will definitely become a part of merger and acquisition books.

M&A market trends 2022: Industries insights

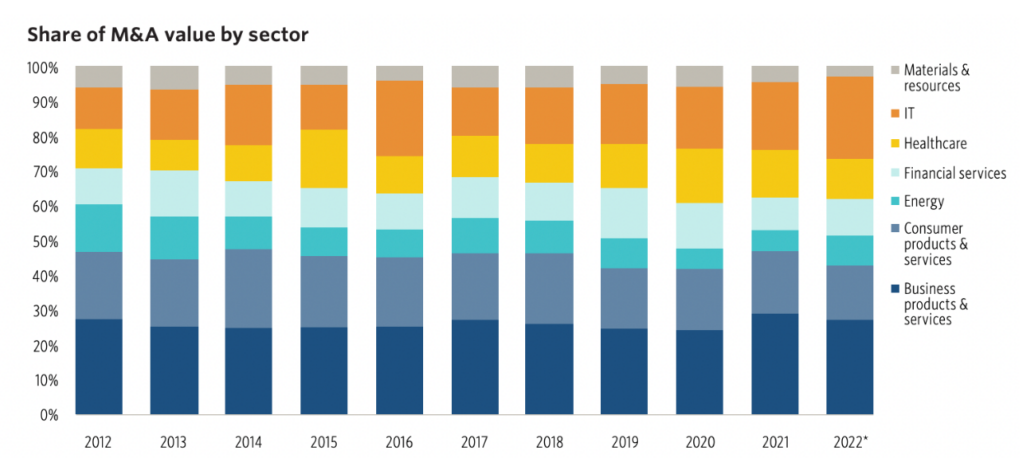

According to the most recent PitchBook report, most 2022 M&A deals happened in:

- Business products and services

- Consumer products and services

- Energy

- Financial services

- Healthcare and life sciences

- Information technology (IT)

Source: PitchBook

Let’s look closely at the dealmaking value and count in each of these sectors.

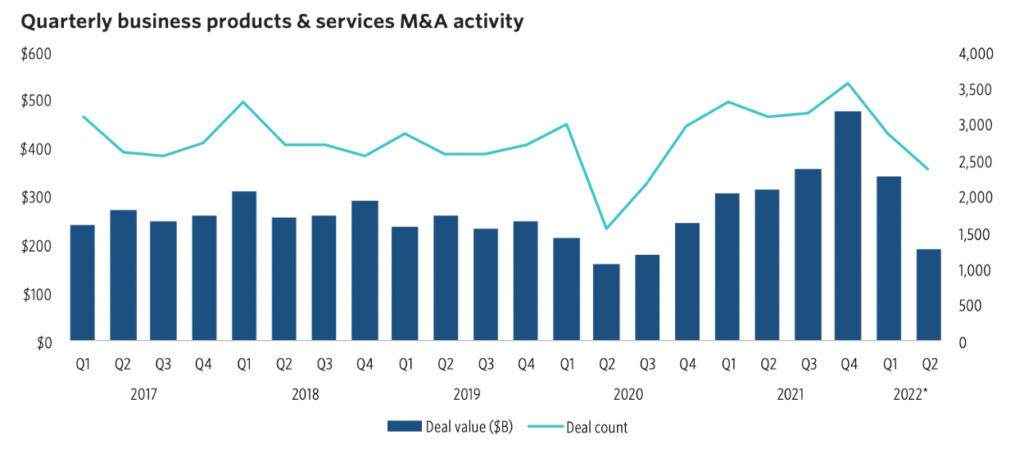

Business products and services

Source: PitchBook

The overall value of M&A transactions in the business products and services sector is estimated at around $300 billion in Q1 2022 and near $200 billion in Q2 2022. The deal number is almost 2,500 transactions.

Key insights

- The main theme of M&A deals in this sector is a supply chain.

- Public-to-private transactions are prevailing.

- Corporate divestitures were the reason for the majority of private equity deals.

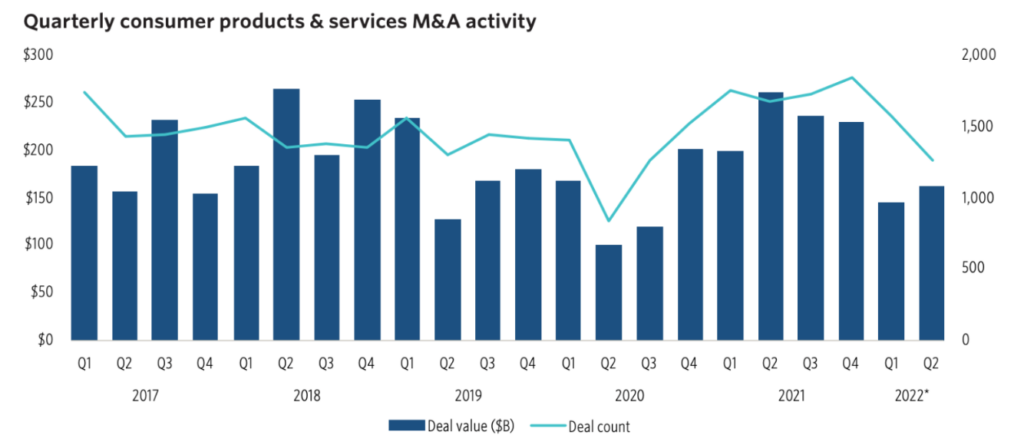

Consumer products and services

Source: PitchBook

The overall value of M&A transactions in this sector has relatively increased in Q2: nearly $150 billion, compared to a little more than $100 billion in Q1. 1,200 M&A transactions in the consumer products and services industry have occurred since the beginning of 2022.

Key insights

- The hospitality industry has experienced an increase in M&A deals.

- Corporate divestitures and portfolio reshaping are the main reasons for mergers and acquisitions in this sector.

Energy

Source: PitchBook

The energy sector counts around 200 transactions since the beginning of 2020. Their total value is estimated at almost $100 billion in Q2, which speaks about an increase compared to Q1, with the M&A transactions value of around $65 billion.

Key insights

- The deal activity is especially intensified in Europe because of the geopolitical tensions in that region.

- Oil and gas prices are in the investors’ focus, though it’s still hard to forecast long-term industry prospects.

- There’s a difficulty in relying on renewables to address a decline in fossil fuels, but it has not deterred the EU deal-making in the space industry.

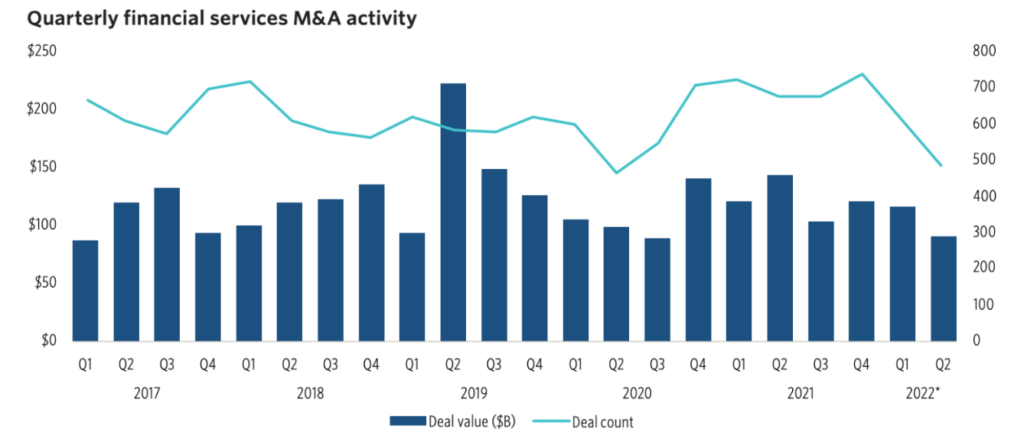

Financial services

Source: PitchBook

The overall number of financial services M&A transactions in 2022 is almost 500 deals. The total value was estimated at about $100 billion in Q1 and has slightly decreased to nearly $80 billion in Q2.

Key insights

- The drivers of financial services M&A deals are insurance and asset management.

- Digital transformation, scale, and restructuring are the focus of the majority of financial services transactions.

- Though the M&A activity has slowed down, the value of deals keeps rising.

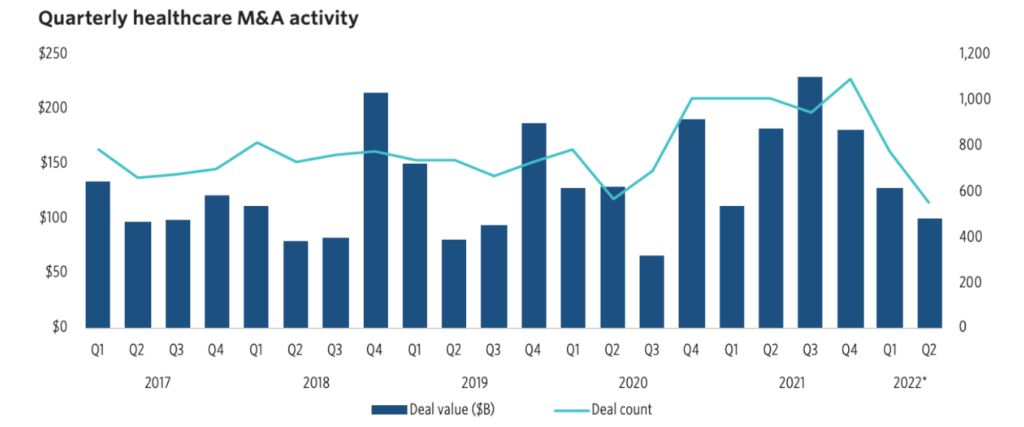

Healthcare and life sciences

Source: PitchBook

The life sciences and healthcare industry had almost 600 transactions since the beginning of 2022. Their total deal value has somewhat decreased from around $120 billion in Q1 to nearly $100 billion in Q2.

Key insights

- The global economic slowdown significantly influences healthcare mergers and acquisitions.

- Healthcare M&A deals contribute to the decline in the number of public companies.

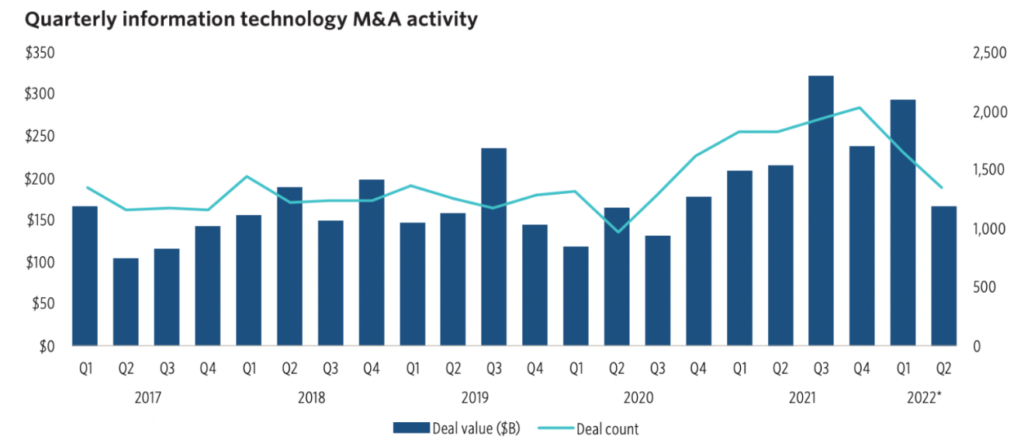

Information technology

Source: PitchBook

The overall number of M&A transactions in the IT sector is almost 1,500 by the end of the first half of the year. Their overall value in Q2 has significantly decreased compared to Q1: from nearly $300 billion to around $150 billion.

Key insights

- The tech industry remains on the rise in 2022 M&A dealmaking.

- Entertainment software is the focus of the majority of M&A deals.

- Private equity finds opportunities for take-private transactions.

Local M&A trends 2022

Now, let’s outline the key 2022 M&A insights and M&A trends based on geography.

North America

- The North American M&A sector has experienced a slight drop in deal count and value in the second quarter of 2022 compared to the beginning of the year: a decline of 30.2% and 37.6% respectively.

- The major headwinds for 2022 are inflation, pandemic-related supply chain shortages, and geopolitical tension.

- The prolongation of the Russian invasion of Ukraine could cause a freeze in credit markets and a significant slowdown in M&A transaction volume.

Brazil

- Upcoming elections in Brazil will inevitably have an impact on the M&A transactions sector. It’s still hard to predict what course it will take.

- The top deal-making sectors in Brazil are IT (41%), media and entertainment (7%), healthcare (6%), financial services (4%), real estate (4%), logistics (3%), oil and gas (3%), and education (2%).

- Despite uncertainties in the Brazilian M&A sector in 2021, M&A activity is believed to remain strong in 2022.

Europe

- European M&A activity is about to slow down in the second half of 2022 due to the palpable macroeconomic headwinds and geopolitical tension.

- Private equity deals’ share will continue to grow. During H1, more than one in three deals was closed by a sponsor. This is an increase from 27% five years ago, and this tendency will continue.

- The European IT sector is going to keep booming, despite the geopolitical situation. The majority of companies considering M&A in the IT industry seek new capabilities or digitalization.

Summary

Despite geopolitical tension and other critical issues, the global M&A activity isn’t likely to slow down substantially.

Among the main forecasted 2022 M&A trends are:

- Private equity deals prevalence

- Increase regulatory scrutiny

- Sanctions and price hikes resulting from the ongoing war in Ukraine

- ESG agenda

- Digital transformation

- Bracing for tighter liquidity

- Divestitures and spinoffs as corporate strategy focus

The top-demanded industries for M&A transactions remain almost unchanged compared to 2021: IT, financial services, healthcare, energy, consumer goods and services, and business products and services.

As for the local M&A 2022 trends, the year will continue to be challenging. Due to the many market challenges and uncertainties, the already lower deal activity levels will likely slow down in the coming months.