The rapid growth of artificial intelligence (AI) is reshaping industries and creating new opportunities. At our recent event in Hong Kong, hosted in partnership with Ideals, investment experts explored how businesses in China can capitalize on the evolving AI landscape.

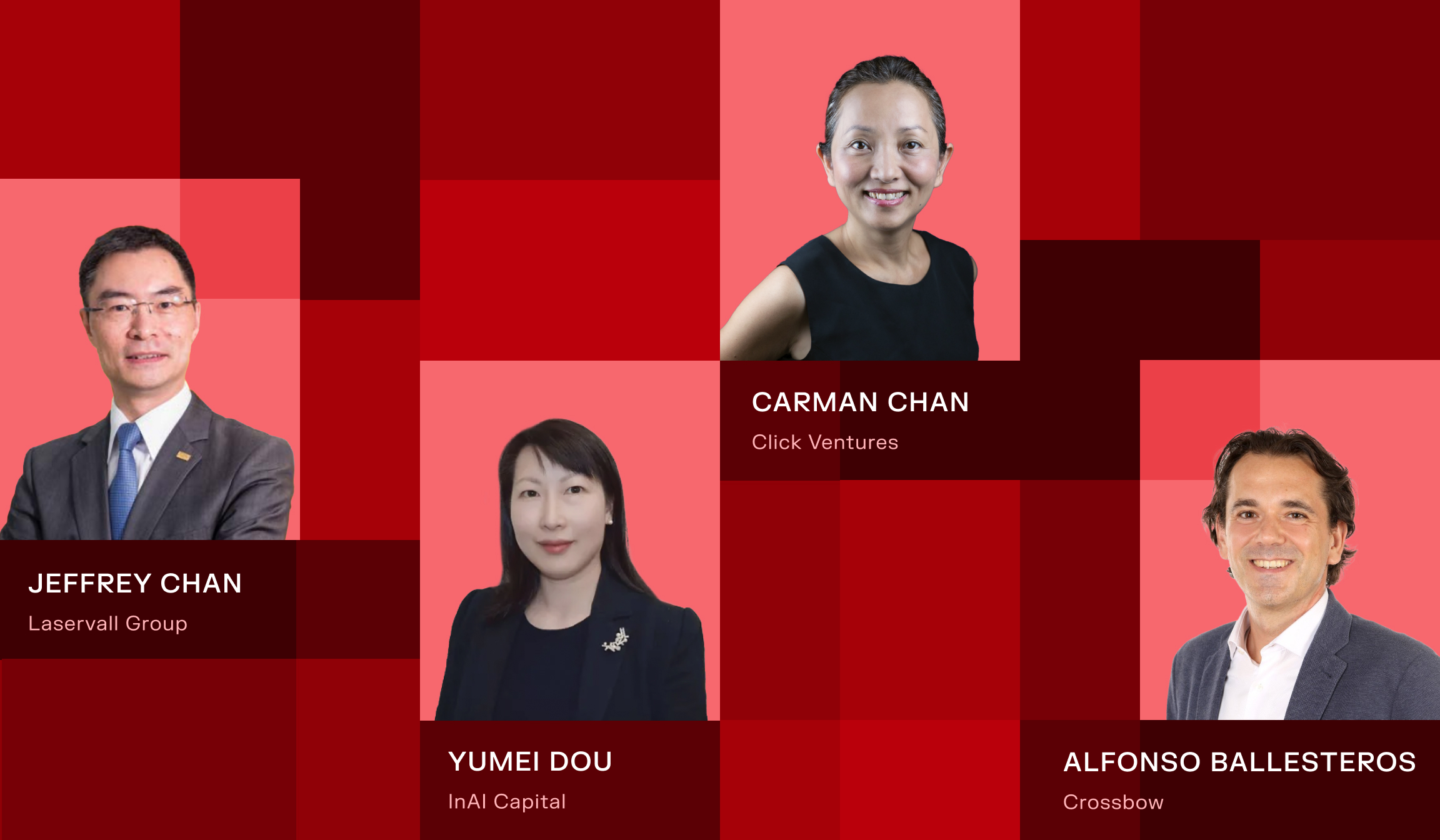

This article highlights the main takeaways from the panel, moderated by Alfonso Ballesteros, Founding Partner at Crossbow and Chairman – Europe Committee at Hong Kong General Chamber of Commerce (HKGCC). The discussion featured insights from Yumei Dou, Founding Partner at InAI Capital; Carman Chan, Founder & Managing Partner at Click Ventures; and Jeffrey Chan, CEO/Co-Owner CFO at AS Virtual Finance/Laservall Group.

Demand for AI infrastructure is growing

Yumei Dou says, “The biggest opportunity in AI is infrastructure and how to process the data. Just like getting power to each device, this is fundamental to support AI and the new applications.” As businesses expand their AI offerings, the volume of data to manage will increase.

Infrastructure is fundamental to support AI and the new applications.

Yumei Dou, Founding Partner at InAI Capital

This makes data centers a critical component in supporting the growth of AI. McKinsey trend analysis reveals that global demand for data center capacity could rise at an annual rate of between 19%-22% from 2023 to 2030. That means twice the data center capacity built since 2000 would have to be built in less than a quarter of the time.

“You need big money to invest in the media and the next generation of data centers,” says Dou. “In three or five years, we’ll see AI becoming a very powerful tool, but it must have a physical body and an entity to interact with other people. This is the next stage of technology innovation.”

In three or five years, we’ll see AI becoming a very powerful tool, but it must have a physical body and an entity to interact with other people. This is the next stage of technology innovation.

Yumei Dou, Founding Partner at InAI Capital

This requirement of “big money” can be seen in the market. JP Morgan research shows that the ‘Magnificent Seven’ — Apple, Microsoft, Nvidia, Alphabet, Amazon, Meta, and Tesla — now account for nearly 35% of the S&P 500 market cap, as they gear up to be key players in AI.

Therefore, investors will need to work hard to identify new opportunities in infrastructure in what is already an expensive sector. Dou highlights investment opportunities in the supply chain, “in elements such as parts, smart cars, energy, motors, and products.” These are essential to support the deployment of AI.

Scalable AI offers new opportunities

When ChatGPT launched, it quickly gained popularity among personal users. However, Carman Chan highlighted a major limitation for businesses: “Companies didn’t want to contribute private data to the foundation model.” These concerns over data ownership slowed down the adoption of AI for enterprises.

I recently invested in a technology startup that introduced revenue less than a year ago and it has already reached $15 million.

Carman Chan, Founder & Managing Partner at Click Ventures

This year, advancements like Retrieval-Augmented Generation (RAG) have helped businesses overcome these challenges. Using RAG, companies can securely store their data by creating a separate layer that integrates with the foundation AI model. This ensures data privacy, allowing businesses to retain full control over proprietary information.

These innovations have made it simpler to develop AI applications that are both secure and scalable, creating opportunities for businesses and investors. As Chan shared, “I recently invested in a technology startup that introduced revenue less than a year ago and it has already reached $15 million.”

Manufacturing is primed for innovation

While tools like ChatGPT often steal the AI limelight, Jeffrey Chan insists that investors look at the application of AI in industries such as manufacturing. “Manufacturers can use machine learning and AI-enhanced sensors to eliminate costs and stoppages in the production process,” he says.

Machine learning algorithms can analyze large volumes of supply chain data, providing real-time insights to improve demand forecasting. This reduces the risk of costly product surplus and maximizes profitability. Similarly, AI sensors ensure production runs smoothly, continuously monitoring equipment to anticipate potential failures. This minimizes unexpected downtime, and allows maintenance to be performed only when necessary.

Manufacturers can use machine learning and AI-enhanced sensors to eliminate costs and stoppages in the production process.

Jeffrey Chan, CEO/Co-Owner CFO at AS Virtual Finance / Laservall Group

While these applications are not yet widespread, AI is expected to transform manufacturing in the coming years as companies invest heavily in the technology. Research from the World Economic Forum reveals that investment in AI for manufacturing is expected to grow by 57% by 2026.

Regional dynamics present risks and rewards

The development of AI in the US and China is being shaped by regulatory and geopolitical factors. Dou points out the differences between the two regions, stating: “China focused too much on government support, whereas the US focused on how clients can generate subscriptions and revenue. In terms of innovation, the US is at least five years ahead.”

While Chan agrees that “most AI foundation models in the US are more advanced,” she holds a more optimistic view on China’s progress. Chan explains that concern around government censorship has fostered greater collaboration among Chinese entrepreneurs, making them less reliant on foreign suppliers. As a result, “We’ve seen their innovation mature, and Chinese companies that are now expanding internationally are leading in their fields.”

“Countries have different geopolitical issues so you need to identify the risks and spread them across different data centers.”

Jeffrey Chan, CEO/Co-Owner CFO at AS Virtual Finance / Laservall Group

Though Dou and Chan have differing perspectives, Jeffrey Chan offers pragmatic advice to businesses navigating regional dynamics in AI development. “Countries have different geopolitical issues, so for AI and hi-tech development, you need to identify the risks and spread them across different data centers.” Chan highlights how his organization applies this diversification strategy. “We have centers in Korea, China, and Hong Kong, which enables us to cater to different customers and distribute risk effectively.”